Welcome to Injective’s monthly update!

The momentum of the past few weeks continued to help create another record-breaking month.

Starting with the Canary Chain phase two launch, governance proposal procedure release, and finally the initial spot markets unveiling, this month has proven that no goal is too high to achieve. The Injective community has been on a roll this summer, so get ready for quite the highlight reel!

July Highlights

- Mainnet updates: Injective published the official Canary Chain video walkthrough and launched the Injective Governance Proposal Procedure. After releasing Canary Chain spot trading, the initial spot markets as well as a spot trading guide were published. The UpOnly exchange went live and Binance came aboard as Injective’s latest genesis validator. Finally, a guide was published to help users select a staking validator.

- Injective completed a successful audit by Informal Systems.

- Injective integrated with a number of projects including Lithium and Crypto.com.

- Injective received shoutouts from Helios Staking, Citadel.One, Ubik Capital and BSC News.

- Community: A few editions of the Orbit Newsletter were published and the first ever Discord community call took place. Injective contributors also participated in a number of AMAs and conferences such as with SCB 10X (the national Thai Bank that is also an Injective validator).

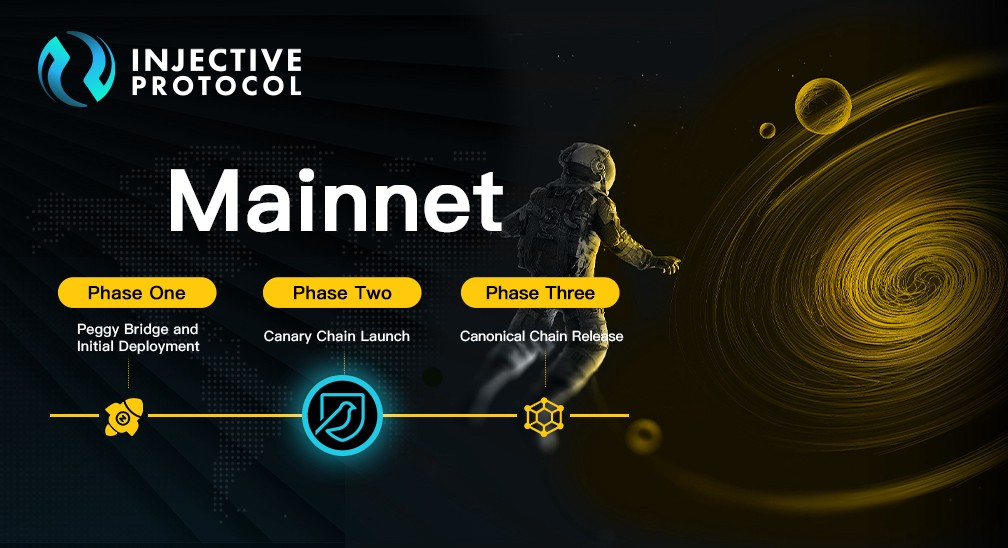

1. Canary Chain Release

This month was all about Mainnet. Within weeks the Injective community contributed to the successful launch of both phase one and phase two of Mainnet, in which the Injective Canary Chain was deployed. To support this landmark achievement the official Canary Chain video walkthrough went live to help users navigate the staking process.

This month also saw the release of the Injective Governance Proposal Procedure. Governance can be used to propose new markets for listing on the Injective exchange, change the staking APY or any other parameter of the protocol as a whole. By facilitating this, Injective is able to pioneer a new economic system that is free, fair, and entirely governed by the global Injective community.

The next Mainnet milestone was the release of Canary Chain spot trading along with the announcement of seventeen initial spot markets. This was enabled via a decentralized governance process with the community voting to release spot trading. Users can refer to the handy spot trading guide, and access the Injective exchange via various frontend relayers. Spot trading will serve an integral role in anticipated discussions about launch perpetuals and futures trading.

The UpOnly exchange went live, becoming one of the first Injective relayers to go public. UpOnly exchange is powered by Genesis Block Ventures (GBV), a prominent investment firm. Binance came onboard as Injective’s latest genesis validator, a company which needs no introduction.

After this, Binance Staking launched INJ staking with up to 33.12% APY. As most readers know, Binance has been with Injective since day one, and it’s exciting to witness just one more way in which they are supporting the community. To wrap up this month of Mainnet madness, a guide was published to help users choose the best staking validator to fit their needs.

2. Informal Systems Audit

Informal Systems audited the Injective codebase and the Injective chain. Informal Systems is a leading auditor specializing in Cosmos-SDK-based projects. The Informal team is composed of world-class researchers, engineers and operators, led by CEO Ethan Buchman, who co-founded Cosmos and Tendermint.

The focus of this audit, which can be read in full here, was to review the codebase for both spot and derivative markets. Very minor errors were found in the code base and were quickly fixed by developers. The Informal audit report reassured all that every component of the exchange is secure and reliable, and the community looks forward to the Injective DEX on the Canary Chain, which marks one step closer to the long-awaited Canonical Chain release

Moving forward, rigorous testing will continue to be performed on the codebase to ensure the stability of the exchange. Caution is of the utmost importance with regards to security to ensure the safety of funds.

3. Collaborations & Integrations

This past month, Injective integrated with a number of projects including Lithium Finance and Crypto.com.

Injective collaborated with Lithium Finance, an oracle built to regularly price illiquid assets using collective intelligence. This collaboration focuses on creating new markets for Pre-IPO stock derivatives on Injective for popular companies that are not yet publicly traded such as Stripe or SpaceX.

Injective news and updates can now be accessed by millions of users on Crypto.com. This was achieved through the RSS feed integration with Crypto.com.

4. Injective in the News

Injective received a number of shoutouts from media sites and fellow projects this month.

Citadel.One, one of the original genesis validators, posted an article on Injective FAQs.

Ubik Capital, another genesis validator, published an overview of Injective’s unique offerings within the DeFi space.

Helios Staking took a deep dive into Injective and spoke about overall goals.

BSC News praised Injective’s new spot trading launch.

Multiple staking providers such as Huobi Pool and Figment also put their support behind Injective.

5. Community

INJ listed on Indodax, the largest Indonesian exchange. It is thrilling to welcome millions of prospective new users in what is today the 4th most populous country in the world.

To kick things off, Injective enthusiasts put together the first ever Discord community call. Regular community calls will be crucial for Injective to flourish as a community-governed protocol.

The weekly Orbit Newsletter continued to hit the shelves, offering a behind-the-scenes look at the work of Injective Labs and community members. Readers can subscribe, as well as view the full archive of newsletters here.

The community nearly lost track of the number of AMAs and conferences Injective participated in this past month. Be sure to check out the full interviews below:

- DeFi and Oracles: Injective Protocol, Lithium Finance, and Convergence Finance

- Crypto.com AMA with Injective

- Multichain Derivative Markets: Injective on Chorus.One Podcast

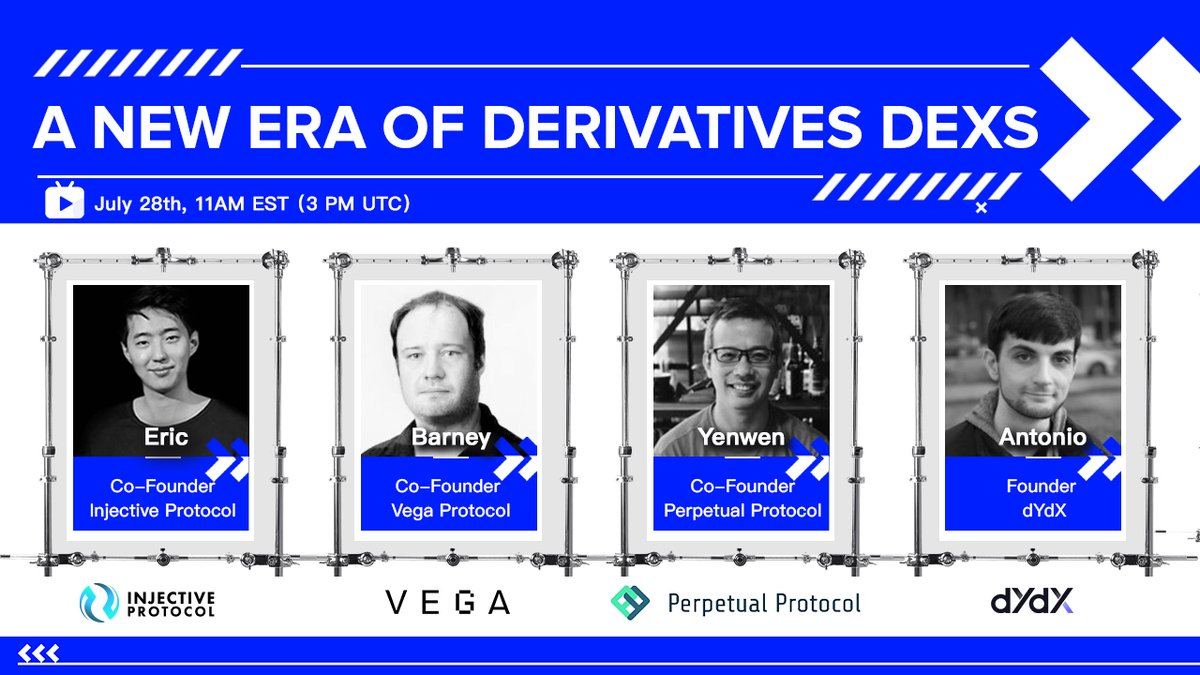

- A New Era of Derivatives DEXs: Injective, Perpetual Protocol, Vega Protocol, dYdX

- Conference with Injective collaborator and National Thai Bank: Injective and the Future of Derivative DEX at SCB 10x Conference

What’s Next

The final stage of Mainnet lies ahead thanks to the invaluable contributions of the community. Don’t miss out on real-time updates through Injective's Twitter, Discord, and Telegram channels.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter