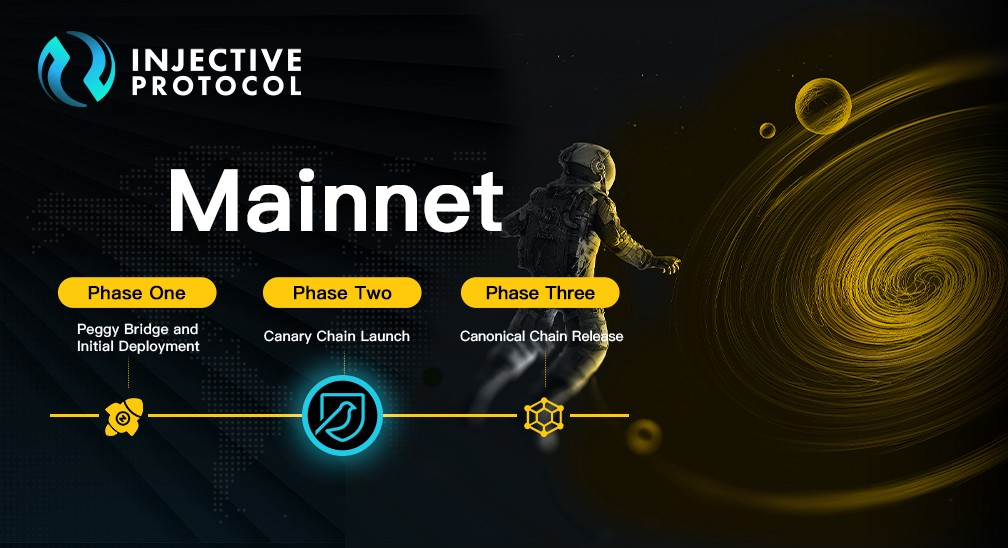

In exciting news, the Injective Canary Chain has been launched, which marks the official start of mainnet phase two! The Canary Chain was officially deployed on June 30 at 1:00 PM UTC with the genesis state found here.

Starting today, users will be able to stake INJ with genesis validators on the Injective Chain. In addition, individuals can bridge over any ERC-20 token onto the Injective Chain using the Peggy Bridge. All governance functionalities have also been released on the Injective Chain, so users can begin to create and vote on new markets on the Injective exchange. Lastly, anyone will soon be able to create and underwrite insurance funds that are needed to trade derivatives markets.

Below is a detailed description of the functionality of the canary chain, as well as the progressive rollout of each component integral to the launch of Injective’s fully decentralized exchange protocol.

Stake your INJ on Mainnet: https://staking.injective.network/

You can find the Injective Mainnet Staking Walkthrough here.

Propose New Markets on Injective: https://staking.injective.network/

*Note: If you staked your INJ during Equinox staking, your funds are safe! A link to the Equinox staking dashboard will be provided, from which you can unstake your INJ. The mainnet and Equinox staking dashboards are separate.

The Injective Canary Chain

In the simplest sense, the canary chain allows Injective users to use real funds within the Injective ecosystem while facing limited risk.

The term canary chain is derived from the concept of canary birds used in coal mines. In the past, coal miners would bring birds called canaries into mine tunnels with them. If dangerous gases such as carbon monoxide were present in the mine, the gases would kill the canaries first before killing the miners, thus warning them to exit the tunnel immediately.

Although the context is quite different, the canary chain functions in a similar manner as to the analogy provided above. In the unfortunate scenario that the canary chain faces any unforeseen issue, a new canary chain can always be deployed. In fact, by design, the canary chain serves this very purpose so that any losses due to outside attacks or threats are minimized as much as possible. Any instability of the canary chain will allow Injective contributors to simply hit “restart” and launch a new canary chain with the added fixes.

To mitigate risk for users, restrictions such as transfer and trading limits will be implemented on the frontend level. Features such as new markets will be rolled out step by step to ensure that all components of the chain are stable.

Canary Chain Phases

As of right now, the Peggy Bridge is live along with the following components of the canary chain:

- Injective Chain Staking

- Governance

- Oracle Module

- Insurance Fund

Peggy Bridge

The function of the Peggy Bridge is to facilitate decentralized bidirectional cross-chain transfers of ERC-20 tokens from Ethereum to the Injective Chain. Users can now begin to bridge over ERC-20 tokens to and from the Injective Chain.

Injective Chain Staking

Staking is now live and made possible by a leading cohort of genesis validators. Users can begin to stake on the Injective mainnet to start earning APY by navigating to the new staking dashboard found here.

Anyone can act as a delegator on Injective without needing to set up complex hardware or to set up any node. The process has been simplified, whereby users can delegate their tokens to any validator to earn rewards directly with the use of MetaMask or even their Ledger wallet.

Note: If you staked your INJ during Equinox staking, your funds are safe! A link to the Equinox staking dashboard will be provided, from which you can unstake your INJ. The mainnet and Equinox staking dashboards are separate.

Governance

One core functionality of the INJ token is to allow the community to propose and vote on all parameters of the protocol through governance.

Injective governance will allow users to propose both spot and derivatives markets on our protocol. Anyone staking on Injective will be eligible to vote on specific proposals. Only when a proposal acquires the required number of votes can it pass and the respective market be listed on the Injective exchange.

Oracle Module

In order to create new decentralized derivatives markets on the Injective Chain, users must have access to price feeds from reliable oracle providers.

The Injective Oracle Module can now be used on the canary chain via which users can retrieve prices for various crypto and synthetic assets using decentralized price feeds. Some of the current oracle integrations include Chainlink and Band Protocol.

Using these price feeds, users can propose new perpetual and expiry futures markets.

Insurance Fund

The Injective insurance fund will be launched on the canary chain in the coming weeks.

An insurance fund is needed to help ensure that users trading on leverage are properly paid out when liquidations occur. On Injective, each derivative market has its own unique insurance fund which has its own specific capitalization.

Before someone can trade on a derivative market, an insurance fund must be created for the market. Insurance funds are initially capitalized by independent underwriters who underwrite the risk of the insurance fund by means of staking the collateral token of the derivative market (e.g. USDT). Then, as trades occur on the market, the insurance fund can grow or shrink depending on the liquidation activity on that particular derivative market. For instance, in order to create an INJ/USDT perpetual market, users would have to stake USDT into the pool.

For a deep dive into the Injective Insurance fund along with illustrative examples please read this article.

Injective Exchange

Once a market proposal is approved by governance, it will be ready for listing on the Injective exchange. As part of the phased launch, the Injective Chain has been launched with two additional governance parameters that must be enabled through a governance vote before spot and derivatives exchange can be executed respectively.

A common question that pops up is, why are markets not available right away for trading? There are three primary reasons for this. First, it is essential to ensure the secure functioning of the Peggy bridge, which is the first decentralized bidirectional ERC-20 token bridge from a Cosmos-based blockchain to Ethereum deployed in production. Although the bridge has been extensively tested during the Equinox testnet, there is no substitute for real experience.

Secondly, it is important for users to become acquainted with the bridge, governance, and insurance fund process on the Injective Canary Chain. This way the community will become equipped with the knowledge and tools needed to rapidly deploy new decentralized markets with ease.

Lastly, this phased canary chain launch helps to actually create a fully decentralized exchange protocol in which all parameters are determined by the community. As a result, the community will be able to propose new markets and vote on them before they are available on the exchange interface.

Please note that during the early parts of the canary chain phase, there will exist a $100 limit for non-INJ ERC-20 token transfers into the Injective Chain.

Next Steps

Moving forward, all activities on the canary chain will be closely monitored to ensure stability. After a few weeks of stability and battle-tested usage, the canary chainwill be made canonical. The canonical chain will function exactly the same way as the canary chain but without any form of limitation.

The canonical chain will include unrestricted trading for a diverse array of new markets with full-fledged governance capability held entirely by the community.

With the final phase in Injective’s mainnet journey ahead, all collaborators, users, and enthusiasts are instrumental in moving forward. The coming weeks will be monumental as Injective showcases an unmatched decentralized exchange protocol to the world.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter