Injective is integrating with the Stacks blockchain to bring fully decentralized Bitcoin derivatives to Injective.

The goal is to create a vibrant multi-chain ecosystem that is entirely decentralized. On Injective, users have the ability to create and trade unlimited derivatives that originate from distinct blockchain networks. With this Stacks collaboration, Injective will be able to launch derivatives that are based on the Stacks token (STX) alongside native assets built on the Stacks blockchain.

In essence, Injective will deploy a bridge that is able to interact with the Stacks blockchain. Users will be able to lock-up and transfer Stacks-based tokens to the Injective Chain which will allow for both market creation and trading for STX as well as other tokens based on the Bitcoin network. DeFi enthusiasts can also take part in creating expiry futures and perpetuals across distinct networks such as BUSD/STX, which would tap into both Binance Smart Chain (BSC) and Stacks for instance.

What is the Stacks blockchain?

Stacks is a layer-1 blockchain solution that is designed to bring smart contracts and decentralized applications (DApps) to Bitcoin. These smart contracts are brought to Bitcoin without changing Bitcoin itself, but leverages its security and stability.

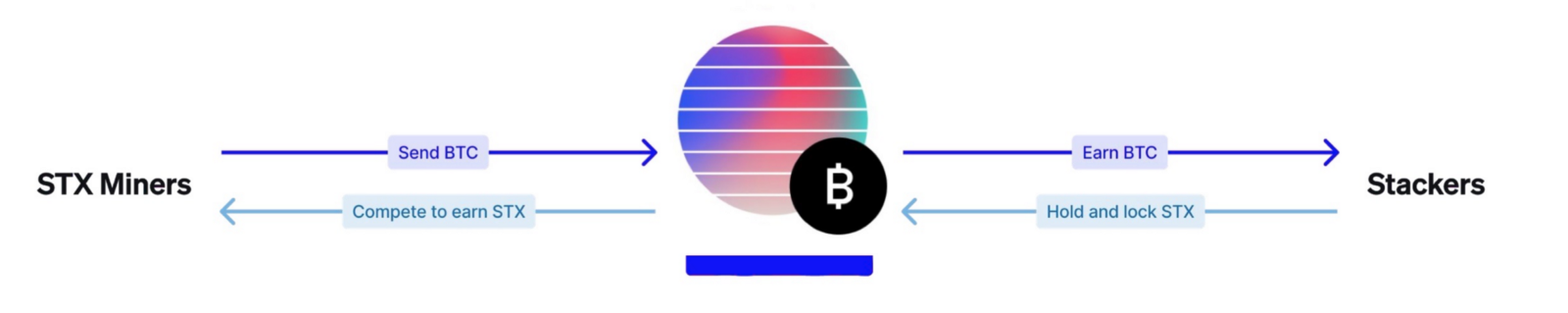

Stacks operates via Proof of Transfer (PoX) which serves as the consensus mechanism between Stacks and Bitcoin. In PoX, miners transfer Bitcoin to the protocol in order to mine new STX, effectively recycling the energy spent on Bitcoin’s Proof-of-Work to secure the Stacks chain. On the other side of the mechanism, STX holders participate by locking their STX for a chosen number of cycles to vote for a specific chain tip. Called Stacking, these participants earn Bitcoin rewards paid each cycle and unlike Proof of Stake systems, there is no risk of slashing for STX holders.

All Stacks transactions settle to Bitcoin, which enables Stacks transactions to benefit from Bitcoin’s security while Stacks scales independently of Bitcoin. To circumvent Bitcoin’s speed constraints, Stacks utilizes microblocks that result in near-instant confirmation on the Stacks blockchain. Miners are currently in the process of adopting this feature and wallets and explorers are catching up to display these faster confirmations. Further, developers can build new DApps on Stacks using the Clarity smart contract language which provides visibility into the Bitcoin state and can include Bitcoin-based logic.

Stacks holders include a broad range of people and organizations, including leading venture funds such as Y-Combinator, Union Square Ventures, and SV Angel.

Bitcoin Derivatives on Injective

Bitcoin is undoubtedly the most popular blockchain network in existence and has spurred the unprecedented growth of the crypto sector as a whole. However, its network speeds and transaction fees inhibit developers from building with Bitcoin itself. To combat this issue, Stacks has created an innovative solution which aims to bring about a better, more secure internet, one including a full range of DeFi products to Bitcoin itself

The mission of Injective is to build a multi-chain universe that acts as a global and borderless network of market exposure. Injective has already begun to build out the ecosystem with upcoming integrations across blockchains such as BSC, Polkadot, Avalanche, NEAR, and many others. This helps form the foundation of one primary hub via which users can access novel markets while retaining an Ethereum-native framework.

“Stacks is perhaps one of the first movers in the crypto space, having started back in 2013. We are thrilled to be joining such a gifted and forward-thinking community to bring Bitcoin derivatives to our protocol as we continue to accelerate the adoption of the Injective multi-chain ecosystem,” said Injective CEO, Eric Chen.

Fully decentralized Bitcoin derivatives are typically out of reach for many in today’s burgeoning DeFi sector. Previously, Bitcoin-based derivatives trading has been somewhat inaccessible, especially for new entrants and retail clients who lack access to institutional-grade Bitcoin derivatives. Now, however, Stacks and the Injective protocol enable users to create both perpetual contracts and expiry futures markets for unique Bitcoin derivatives. In addition, traders will be able to freely take part in new forms of market creation.

“What was previously just a murmur is turning into a roar. Bitcoin DeFi is here to stay. Stacks and Injective are paving the way for Bitcoin-based derivatives and making it clear that DeFi’s future goes way beyond the blockchains and platforms where it started its journey. Together, the two protocols provide new opportunities for regular users to access Bitcoin derivatives in a fully decentralized manner and broadens the ways DeFi can be accessed and experienced. ,” said Head of Growth at the Stacks Foundation, Mitchell Cuevas.

Injective: Bringing Decentralized Derivatives to Bitcoin

Injective continues to become a more robust exchange protocol through which traders can access multi-chain markets. Injective's work with Stacks will pave the way towards introducing new decentralized Bitcoin-based derivative products which are not available elsewhere, enabling Injective to bring forth a new paragon of decentralized finance.

About Stacks

Stacks is a layer-1 blockchain solution that is designed to bring smart contracts and decentralized applications (DApps) to Bitcoin. These smart contracts are brought to Bitcoin without changing any of the features that make it so powerful — including its security and stability.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter