Injective’s EVM Public Testnet marks a defining moment for the future of onchain finance. For the first time, developers and users can access a fully embedded Ethereum Virtual Machine within a high-performance Layer 1 blockchain, purpose-built for speed, composability, and real-world financial applications.

This is not a sidechain or bolted-on EVM. It is a unified execution environment where Solidity contracts can run alongside Injective’s native modules like orderbooks and batch auctions, and even interoperate with WASM contracts in the same runtime. Builders gain unprecedented flexibility, while users enjoy a frictionless experience with near zero gas fees and no seed phrases, just instant access to powerful DeFi applications.

Explore the Injective EVM Testnet Portal to see the future of finance in action: https://multivm.injective.com/

Why Injective’s EVM is Different

Injective’s EVM is embedded at the base layer of the chain, not layered on top. This unlocks core benefits:

- Throughput at scale: Over 20,000 transactions per second with parallel execution and account abstraction

- Gasless UX: Transactions can be signed and executed with no gas fees or wallet friction

- MultiVM composability: Contracts across EVM and WASM can share assets and state by default

- Built-in finance modules: Native CLOB, MEV resistance, and onchain RWAs support advanced use cases

- AI-native infrastructure: Onchain inference allows dApps to integrate intelligent agents in real time

With this foundation, Injective delivers a new standard in DeFi performance and interoperability.

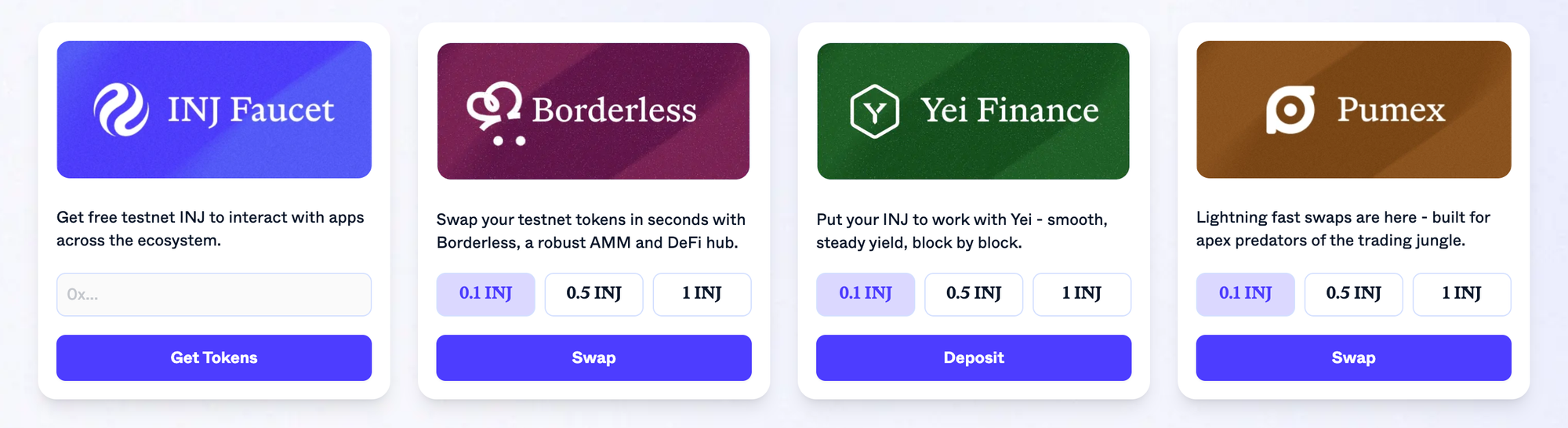

The First Wave of dApps on Injective

A diverse set of applications are already building on Injective’s EVM Testnet from pre-launch markets to AI-optimized yield farming. These are the first dApps unlocking Injective’s native speed, modularity, and financial tooling:

- Pumex: Pumex is a sophisticated DeFi protocol with over $120M in volume that combines automated market making with yield optimization strategies. Designed to democratize access to advanced financial instruments, it enables capital-efficient trading through custom AMM designs and deep liquidity mechanisms. On Injective, Pumex benefits from real-time execution and zero gas fees, making it possible to rebalance strategies and optimize returns with precision.

- Yei Finance: Yei Finance introduces leveraged yield farming and undercollateralized lending into a capital-efficient ecosystem. Users can borrow more than they deposit, generating higher yields for lenders while amplifying liquidity across DEXs. Injective’s modular infrastructure enables gasless transactions and instant composability, letting Yei unlock yield strategies that are prohibitively expensive on other chains.

- Borderless: Borderless is pioneering pre-TGE and cross-chain asset trading. Built to eliminate geographic and technological barriers, the platform allows permissionless trading across multiple blockchain networks. Its roadmap includes a focus on pre-token launch assets, offering new liquidity and discovery paths. By leveraging Injective’s native cross-chain capabilities and fast finality, Borderless ensures a seamless trading experience across ecosystems.

- Lair Finance: Lair Finance enables liquid restaking across chains through Liquid Restaking Tokens (LRTs). Users can stake assets on one chain and use LRTs elsewhere to earn dual rewards. On Injective, Lair maximizes restaking efficiency through fast finality and a cross-chain runtime that simplifies liquidity movement between networks, unlocking powerful dual-income DeFi strategies.

- Stryke: Stryke delivers decentralized options trading that is both low-collateral and highly capital efficient. Modeled after traditional derivatives markets, it allows for the creation, trading, and settlement of tokenized options. On Injective, Stryke integrates with native batch auctions and the orderbook module to support fair pricing and efficient trade matching, all at zero gas cost to the user.

- Bondi Finance: Bondi bridges the world of sovereign debt and onchain markets by tokenizing corporate bonds and coupons. The platform opens access to real-world financial assets traditionally reserved for institutional players. Injective’s native modules and compliance tooling support Bondi’s vision of a permissionless bond marketplace that blends blockchain transparency with traditional asset reliability.

- Timeswap: Timeswap is the first fixed-term lending AMM to operate without liquidations or external oracles. Its three-variable AMM allows for lending and borrowing with complete flexibility over collateral, interest, and time. Injective’s performance ensures accurate rate discovery and seamless trade execution, making Timeswap a powerful alternative to over-collateralized lending platforms.

- Accumulated Finance: Accumulated Finance is a smart yield optimizer that reallocates assets dynamically across the DeFi stack. Its algorithmic capital allocation continuously seeks the best opportunities for compounding yield. Injective’s fast block times and gasless environment allow frequent rebalancing without cost overhead, giving users optimal returns with minimal interaction.

- Orbiter Finance: Orbiter is a fast and cost-effective bridge for moving assets across Ethereum Layer 2s. It supports Optimism, Arbitrum, zkSync, Polygon, and more. As Orbiter integrates with Injective, it becomes the gateway for L2 users to access Injective-native dApps, enabling low-cost, trust-minimized entry into a faster financial ecosystem.

Onboarding in Seconds

Getting started on the Injective Testnet takes less than a minute. There is no need to install extensions, save seed phrases, or pay gas.

Just visit the testnet portal, create a wallet with a click, and begin using any application instantly. Transactions are gasless and signless by design, removing all the friction from Web3 onboarding.

A New Era of Onchain Finance

Injective’s EVM is not just another chain for deploying contracts. It’s a new paradigm where builders can leverage the full power of Ethereum tools alongside native finance modules and MultiVM composability, all without compromising on speed or user experience.

By eliminating the traditional tradeoffs in DeFi architecture, Injective is creating a system where complex financial applications can thrive and evolve. Whether you’re launching a trading platform, building with AI agents, or tokenizing real-world assets, Injective offers the performance and modularity to scale your vision.

Access the Injective EVM Testnet Portal to explore the ecosystem and start building the future of finance today.

The future is open, fast and truly onchain. The future is Injective.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter