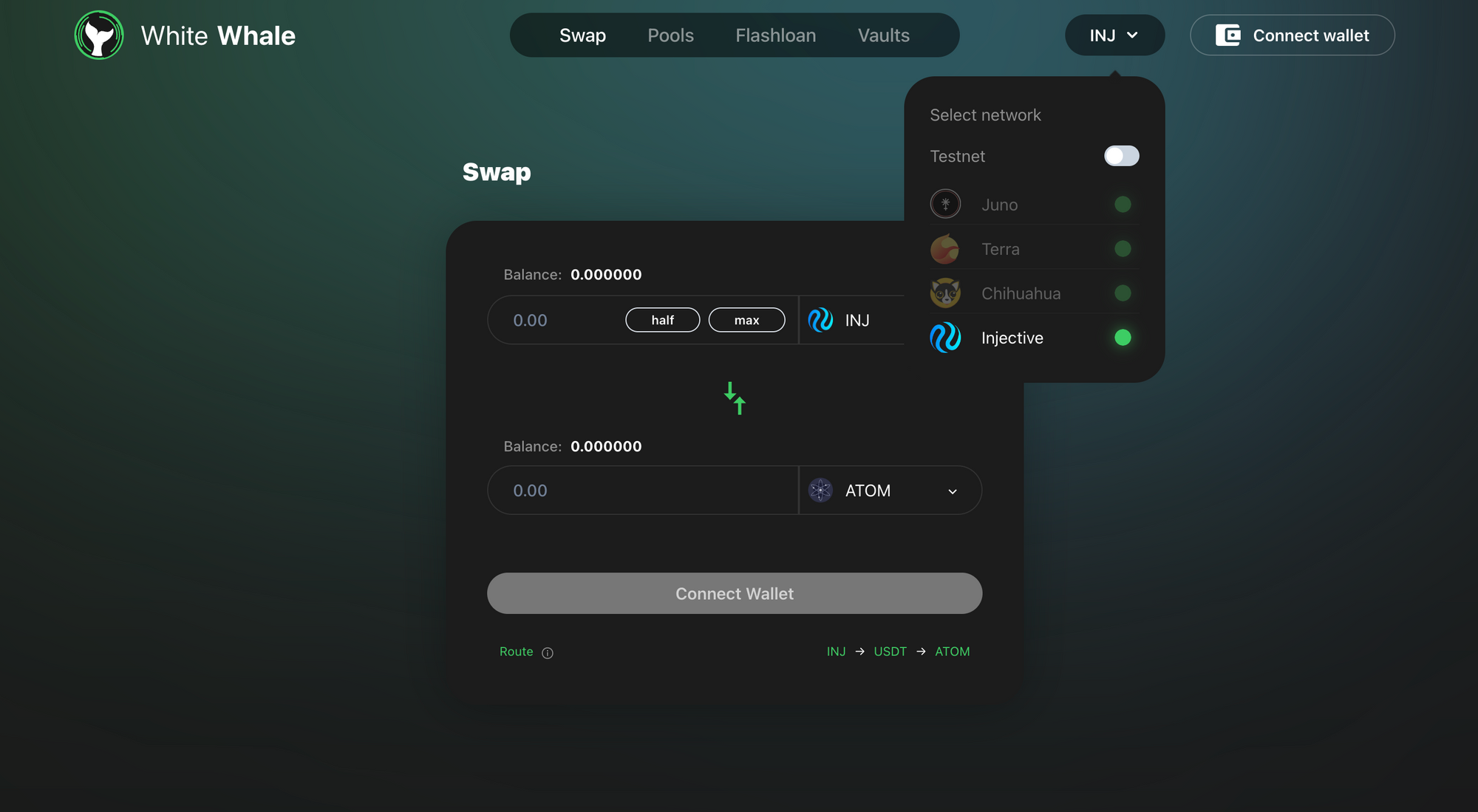

White Whale, the Cosmos interchain liquidity hub, is now live on Injective bringing Flash Loans to the ecosystem for the first time!

Injective users can now participate in arbitrage and flash loans without any barriers. With this new integration, users can easily access a wide array of liquidity pools across the broader Cosmos IBC ecosystem. In addition, White Whale AMMs can work in tandem with Injective's on-chain CLOB primitive to create far more efficient markets. Lastly, arbitrage strategies can be carried out more readily across other IBC-enabled chains which provides users with new avenues to interact with dApps built on Injective.

What is White Whale?

White Whale is an interchain liquidity protocol in the Cosmos ecosystem. White Whale V2 provides a unique interchain liquidity infrastructure in order to decrease fragmented liquidity, fix price disparities, and decentralize market-making in a capital-efficient manner.

White Whale aims to solve the key challenges dApps and chains in the Cosmos ecosystem face:

- Market inefficiencies: The available interchain liquidity is often fragmented across chains. Fractured liquidity results in shallow pools with high spreads and price disparities between chains.

- Capital inefficiencies: Every arbitrageur and liquidator will need their own capital sitting on every chain to efficiently arb or to liquidate borrowers. When there are no arbs or liquidations, the capital sits idle without earning yield.

- Centralized Market Making: As the number of chains increases in the Cosmos ecosystem, substantial capital is required to arbitrage and liquidate across chains. This creates high entry barriers for everyday users.

White Whale introduces a novel Flash Loan and arbitrage protocol that allows users to solve for the aforementioned problems in a seamless manner.

How Does This Deployment Benefit the Injective Community?

Injective has built the first on-chain central limit order book (CLOB) primitive, which is ideal for building new synergies with White Whale’s Bot First Pools (BFPs). White Whale’s BFPs serve as reference prices for local applications which can potentially lead to new arbitrage opportunities. If there exists a price disparity between a BFP and local exchange dApps built on Injective, arbitrageurs can take a flash loan from the vaults to create new trading strategies.

This deployment of White Whale can positively benefit both end-users and dApps built on Injective.

For end-users

End-users will be able to participate in arbitrage, liquidation, and market making with advanced DeFi tools. White Whale has four features on its liquidity hub:

- Swap

- Pool

- Flash Loan

- Vaults

Users are able to swap tokens in and out of pools to generate yield by leveraging price disparities through arbitrage. Experienced users can engage with vaults and flash loans by using open-sourced arbitrage trading bots with no minimum capital requirements.

For dApps built on Injective

Any developer can create their own arbitrage bot and use the Flash Loan Vault infrastructure without minimum capital requirements by leveraging open-sourced arbitrage trading bots.

With the new arbitrage opportunities, dApps built on Injective can offer a more capital efficient environment that is further bolstered by Injective's unparalleled institutional support. This means, more applications and market making strategies can be created on Injective to grow the Injective ecosystem further.

How Was White Whale Launched on Injective?

White Whale deployed a set of CosmWasm smart contracts on Injective entirely via governance. Specifically, the community voted to enable WASM smart contract upload for whitelisted addresses with Injective Improvement Proposal #192 (IIP-192). Effectively this allowed White Whale to upload a number of distinct smart contracts on Injective that are needed in order for the dApp to function properly.

Injective is a blockchain optimized for building financial applications and uniquely supports auto-executing smart contracts as well which allows for a legion of new applications to be created. Moving forward, White Whale can continue to utilize Injective's innovative smart contracts environment to build new functionalities that would not be possible on any other blockchain.

Conclusion

The launch of White Whale on Injective brings accessible opportunities for the Injective community to leverage advanced DeFi primitives such as flash loans and arbitrage pools.

Moving forward, the Injective ecosystem will continue to provide an unmatched launchpad for developers looking to build groundbreaking financial applications with robust capital effiency.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter

About White Whale

White Whale is an interchain liquidity protocol. Through its interconnected Liquidity Hubs on every major Cosmos SDK Chain it aims to solve liquidity fragmentation and price inefficiencies between chains.