The Injective Explorer V2 is now live!

The major upgrades include the addition of a new assets section, a new markets section, asset details across the interchain ecosystem, smart contract code and much more! The deployments bring an unmatched level of usefulness and overall transparency for Web3 builders on Injective.

Injective Explorer V2: Link

Background on Injective Explorer

The Injective Explorer is an analytics platform that visualizes blocks, transaction activities, and blockchain network metrics all in one place. Users can view detailed information regarding every single action that occurs on-chain, such as block status, transaction details, wallet balance, markets information, assets on-chain, etc.

The Injective Explorer was initially launched in October of 2021, just a few weeks before the official mainnet release. The community feedback as well as the development of the Injective ecosystem led to the official launch of the Injective Explorer V2, which creates a diverse array of new use cases.

Injective Explorer V2

The Injective Explorer V2 goes far beyond search capabilities. There are five main sections on the site now: blocks, transactions, contracts, code, markets and assets. Each component showcases distinct information sets and data. In addition, all transactions on both the Injective testnet and mainnet can also be found on the Explorer, with an easy toggle to switch your views.

Below you will find an overview of the major upgrades.

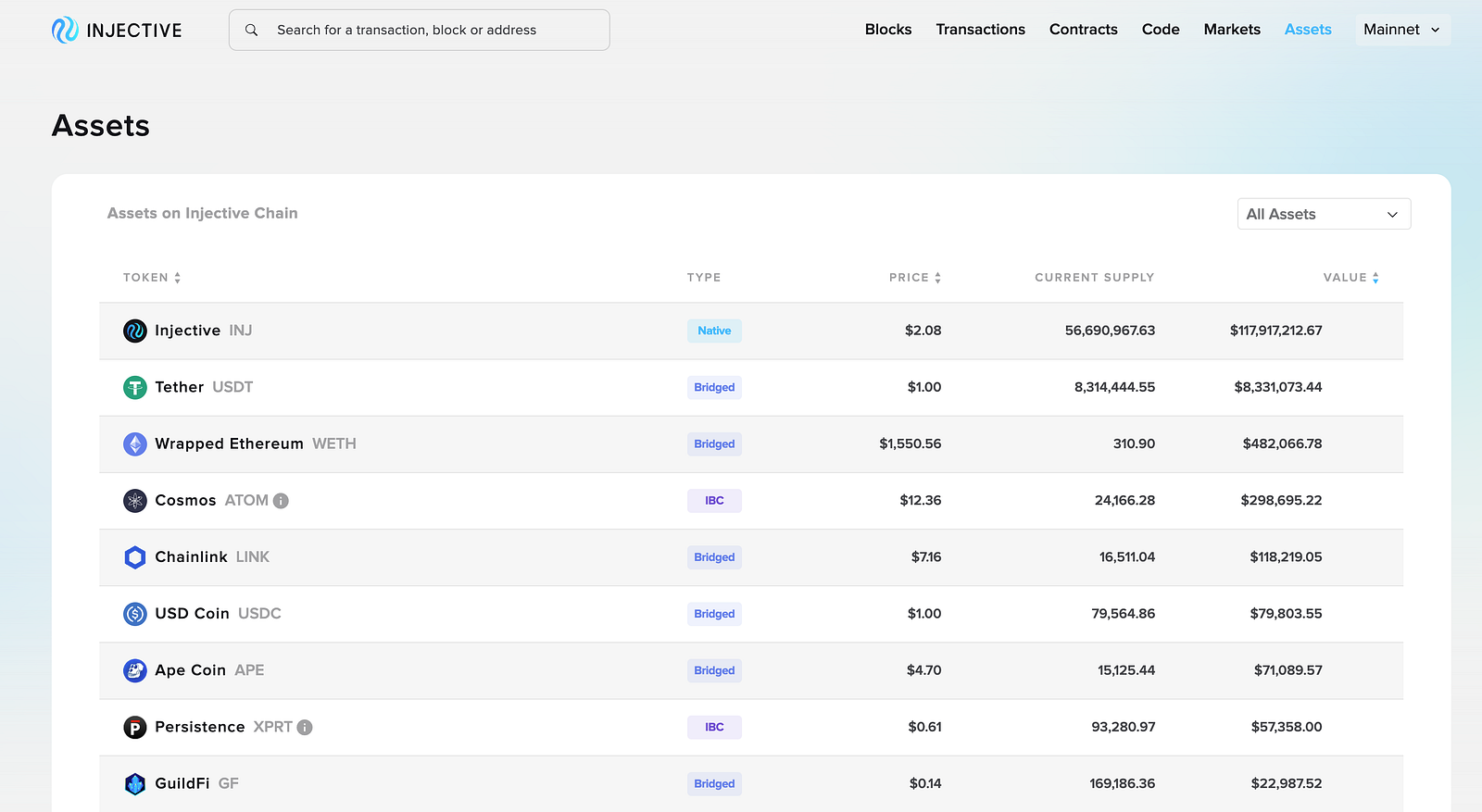

New Assets Section

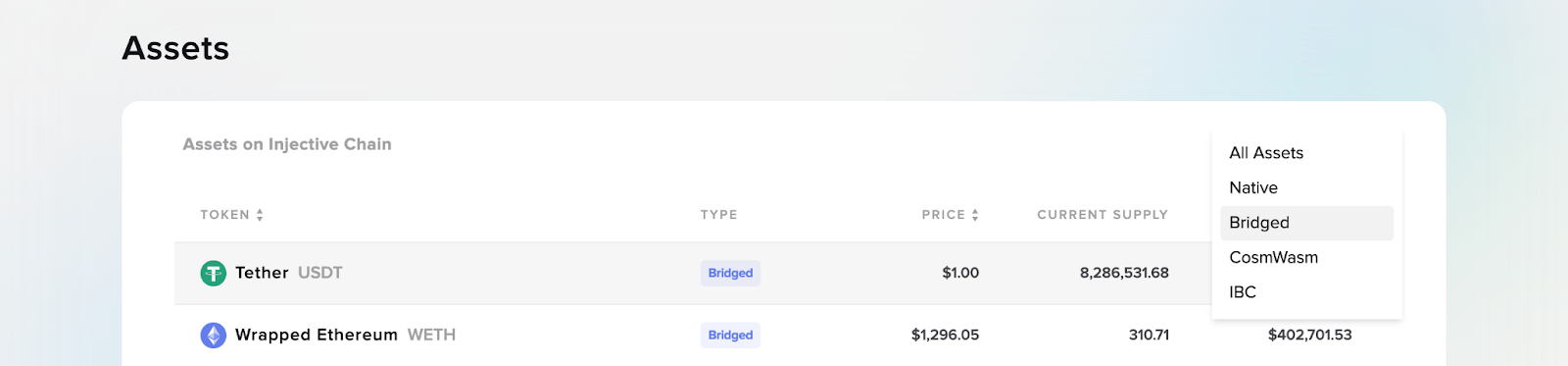

The new Assets page provides an extensive overview of all assets on Injective. Users are able to see the current supply on-chain and the associated notional value of the particular asset.

Furthermore, users can easily switch asset types among native, bridged, CosmWasm, or IBC assets. For instance, if you choose “Bridged”, you will be able to view the assets that have been bridged over to Injective from Ethereum. Selecting IBC will display the assets that have been transferred to Injective via IBC such as ATOM.

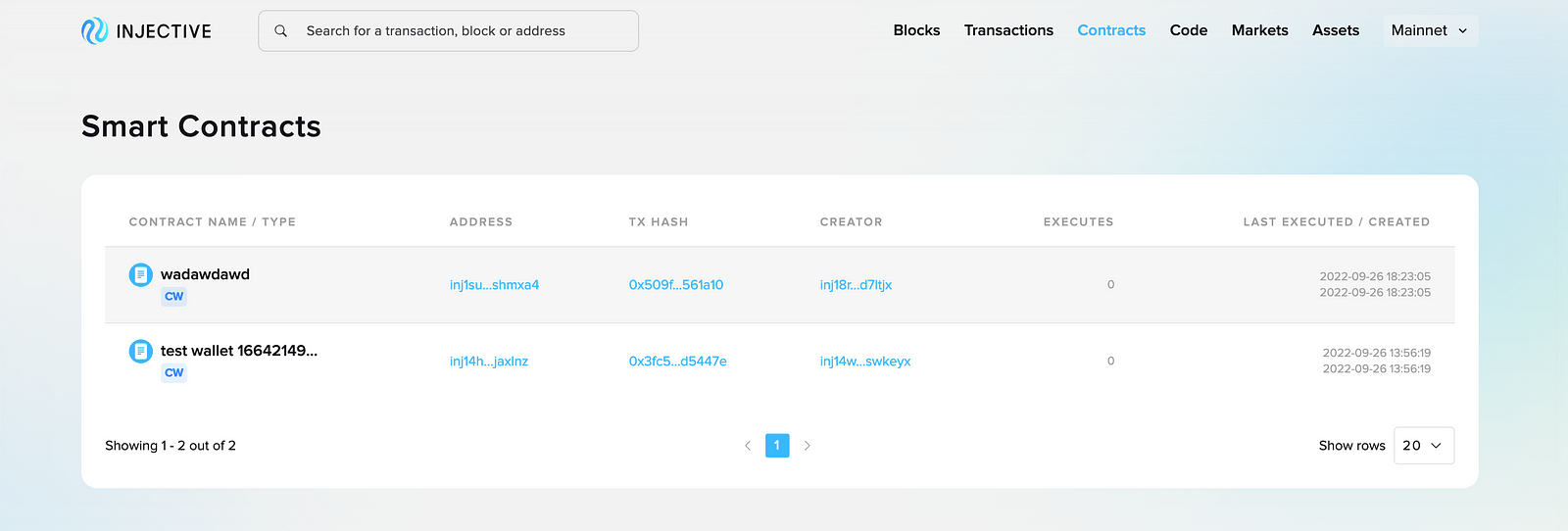

CosmWasm Smart Contracts

On the Contracts page, you will find a revamped interface with new sections that will begin to display CosmWasm smart contract deployments on Injective. Clicking into any contract will lead to a new page with a detailed breakdown of the elements in a specific contract.

Smart contracts are executable codes. Smart contracts on Injective are normally developed using Rust and compiled into WebAssembly (wasm). The code is finally optimized before it is officially uploaded to the chain.

Code

The Code page allows you to explore all WebAssembly (WASM) code templates on chain. Essentially, developers can utilize these code to act as a blueprint for a smart contract. A set of code can be applied to the creation of many different smart contracts.

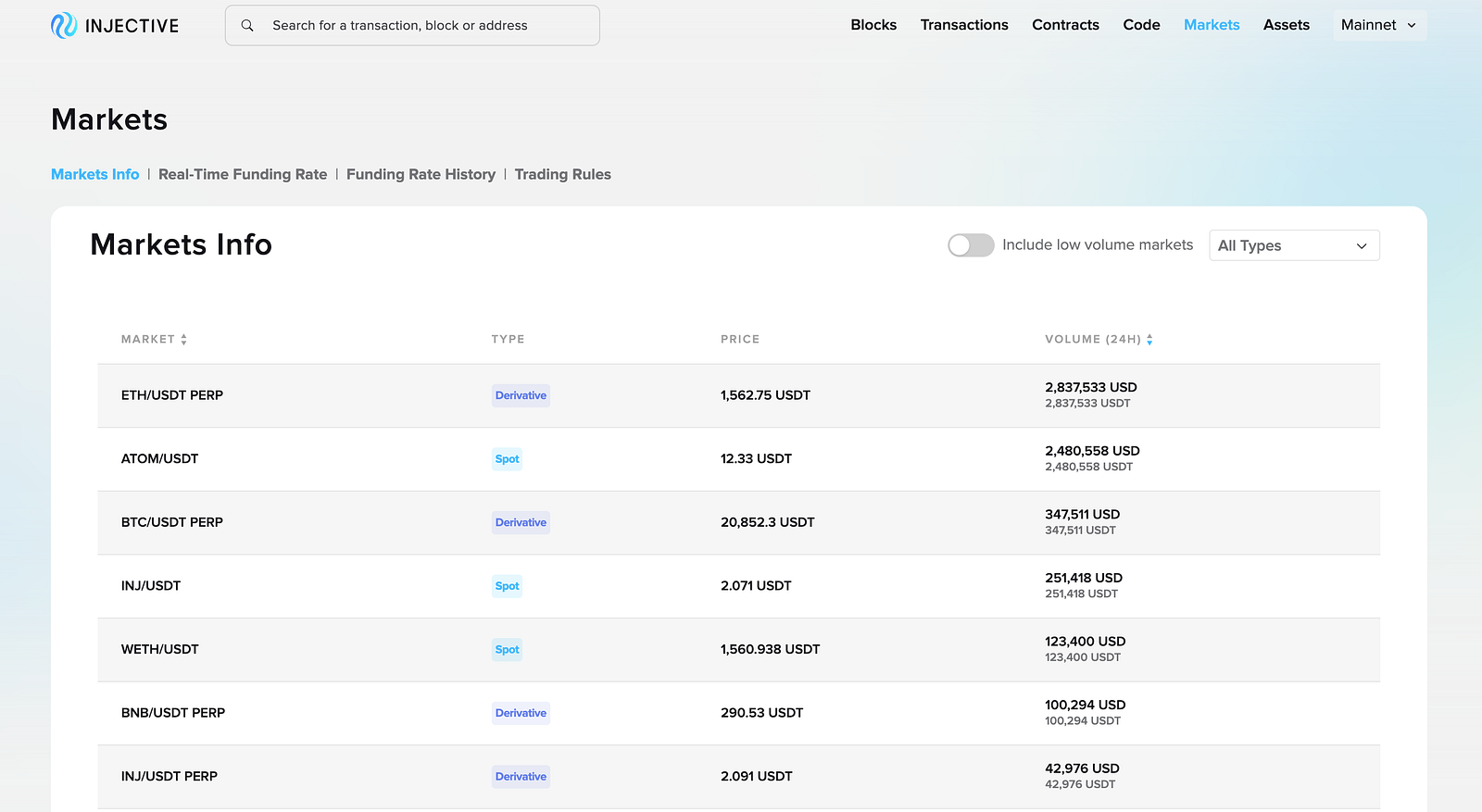

Markets

The Markets page shows all financial markets on Injective that have been launched on top of the Injective blockchain. Users can access these markets via institutional grade APIs or the numerous dApps built on Injective.

The Markets page is broken up into a number of tabs to further enhance the experience for users on the Explorer. The tabs begin with Markets Info which shows general information for each spot or futures market such as asset price and volume transacted.

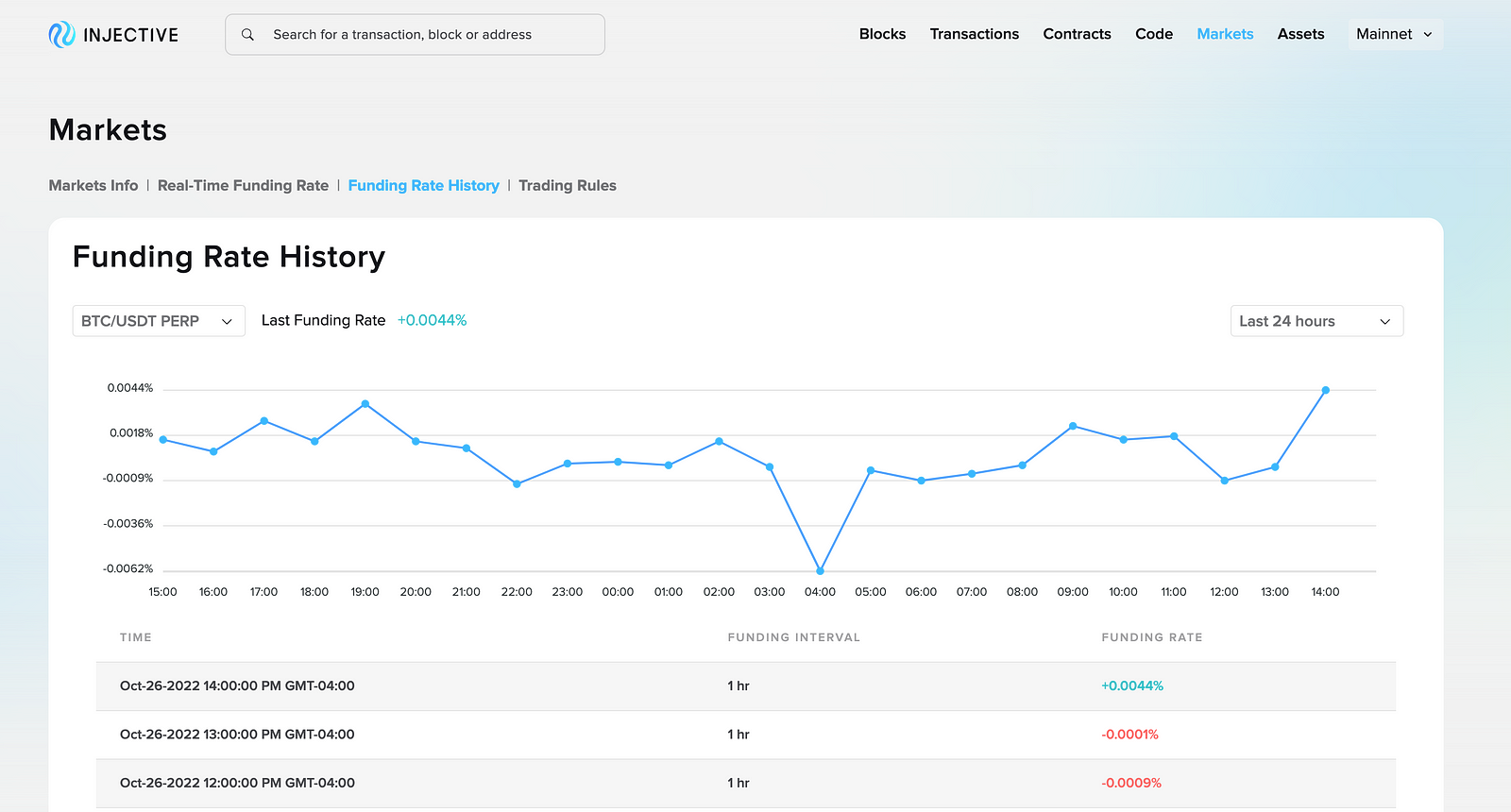

Markets: Funding Rates

As a quick recap, funding in futures markets refers to the periodic payments exchanged between traders that are long or short of a perpetual contract. These payments occur at the end of every funding epoch (e.g. every hour). When the funding rate is positive, longs pay shorts. When negative, shorts pay longs.

Current Funding rates for futures markets can be seen in the Real-Time Funding Rate tab. This includes time remaining until the fund rate is updated and the interest rate users can earn on an hourly basis.

The Funding Rate History section illustrates the changes in funding rates over time time for each market on Injective. Not only do you get a graphical view of the funding rate but also a comprehensive breakdown of the funding rate since the inception of a particular market.

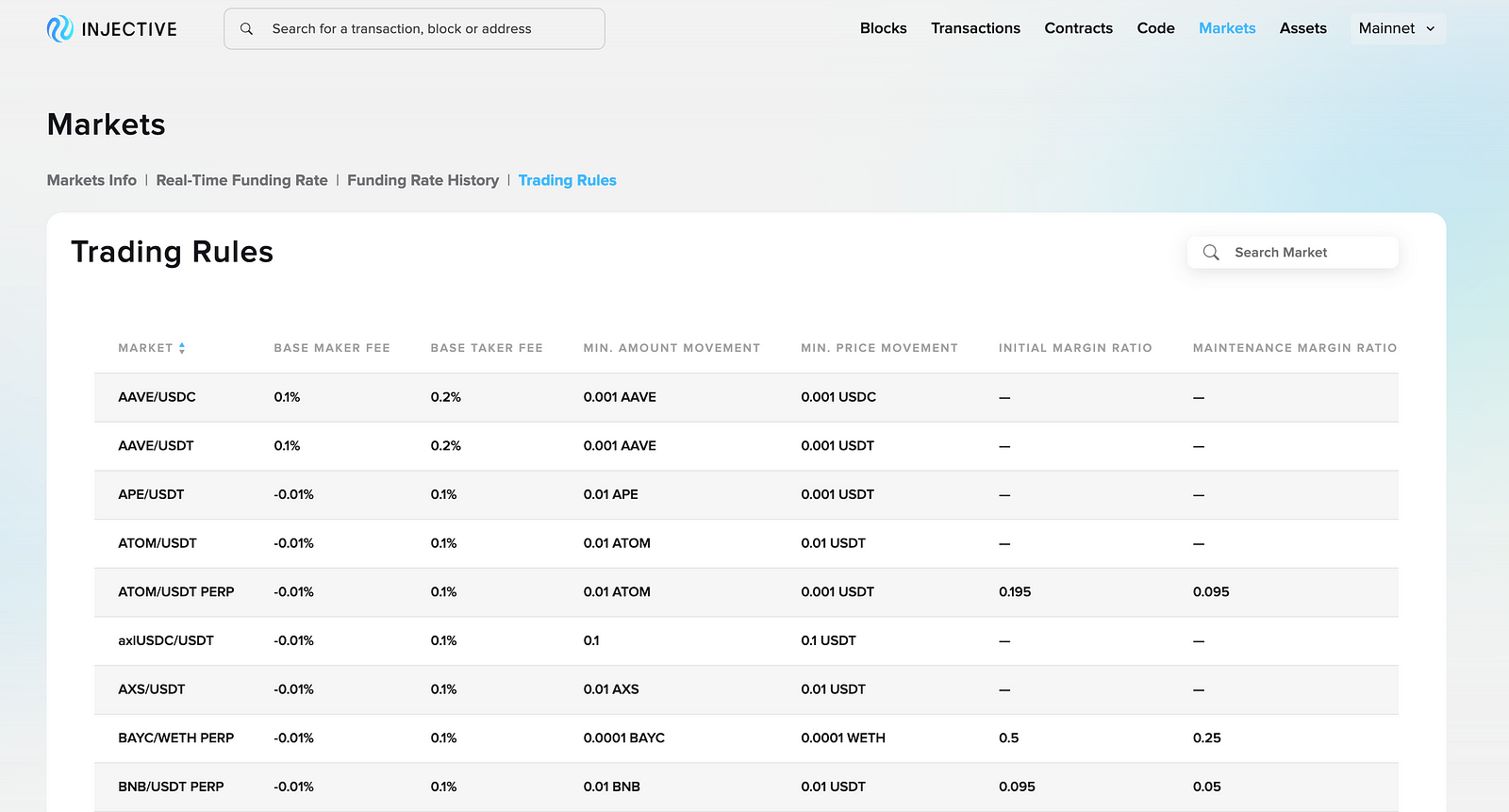

Markets: Trading Rules

There’s also a Trading Rules tab under the Markets page that displays information such as market-specific maker fee and taker fees.

For instance, if a user inputs “ATOM” in the search bar, it will display the fee structure of both ATOM spot and perpetual markets on exchange dApps on Injective. For perpetual markets, you can also view the initial margin ratio and maintenance margin ratio information. Note that maker fee rebates are also supported across a number of markets to allow traders to earn every time a maker order is placed.

Final Thoughts

The launch of Injective Explorer V2 marks another milestone in the Injective ecosystem’s growth. It also illustrates the community’s ability to both execute and drive meaningful upgrades based on shared feedback. Try out the new Explorer and let us know your thoughts!

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter