Injective Insurance Fund staking is now live!

Here is a quick guide for you to follow so that you can stake in an insurance fund on Equinox Staking and start earning rewards.

This guide will walk you through insurance fund concepts and how to use the Injective Staking Dashboard interface to start staking in insurance funds. Once you are familiar with these concepts and the insurance funds interface, you will be able to mint USDT on Kovan, transfer the USDT to our Injective Chain, underwrite to an insurance fund, and request redemption from an Insurance Fund.

If you would like to gain an overview of the Injective Insurance Fund and how it works please read here.

FAQs for the Insurance Fund can be found on the staking dashboard after you connect your wallet.

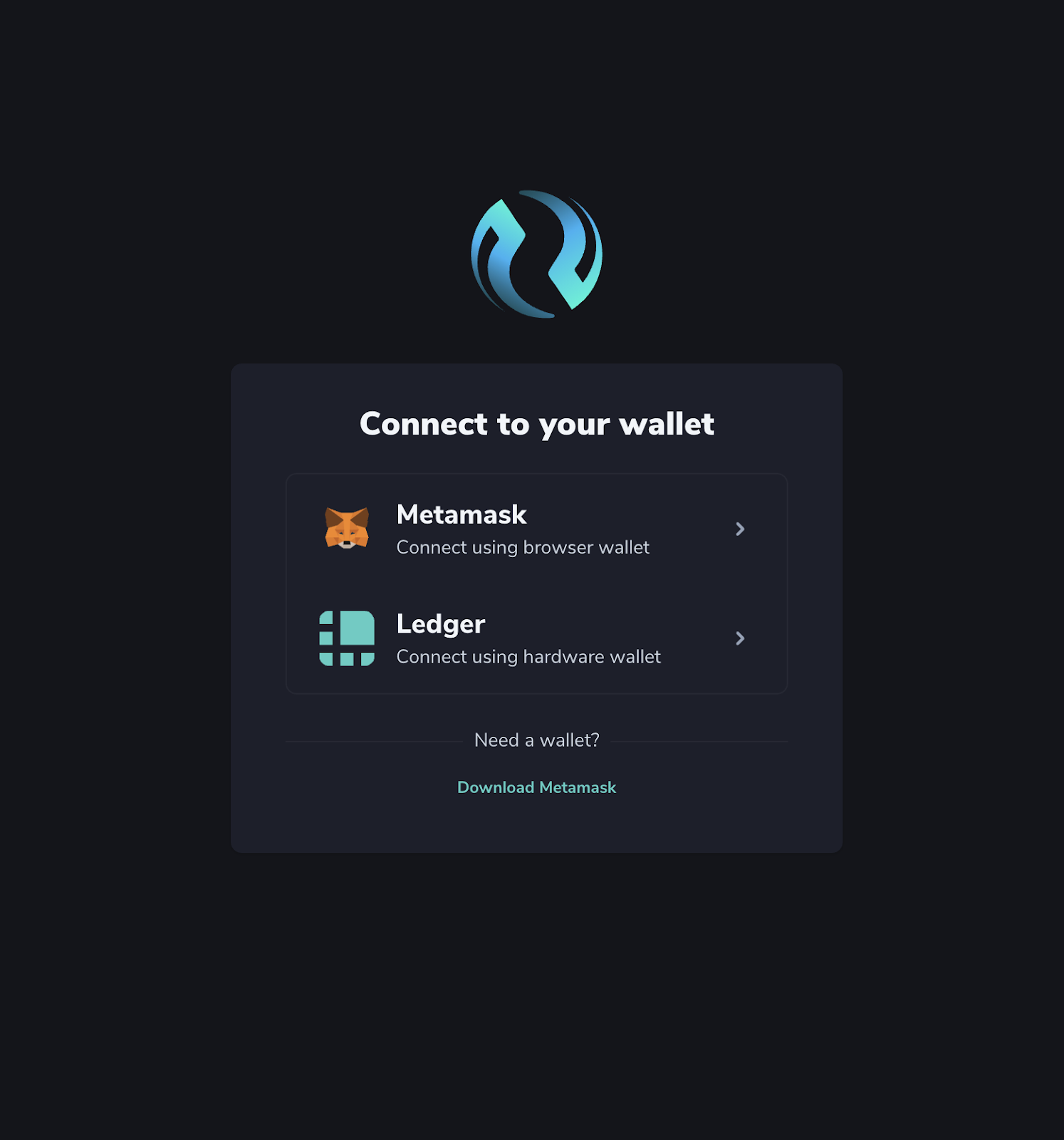

1. Connect Your Wallet

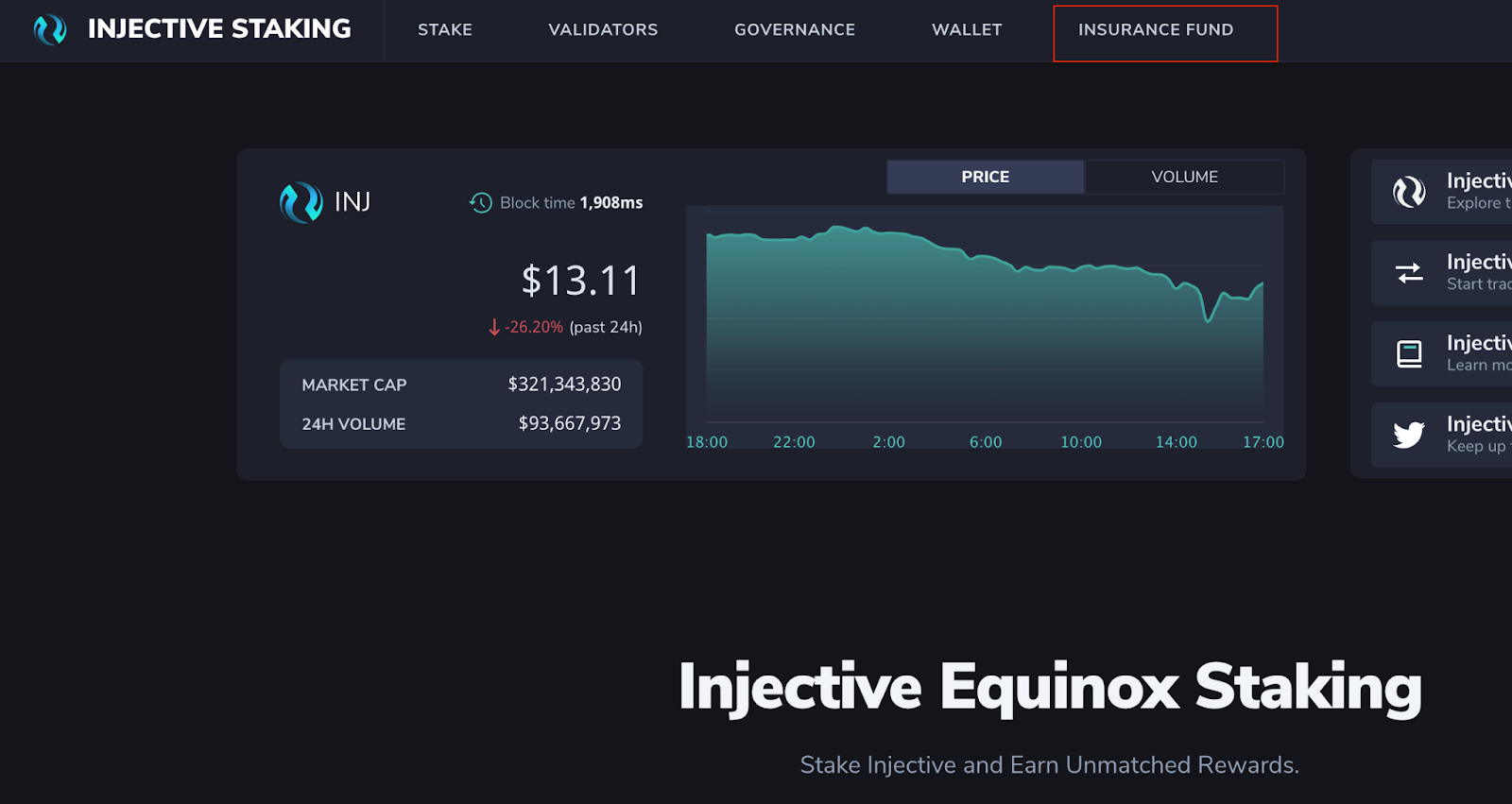

Open the staking dashboard: https://staking.injective.network/

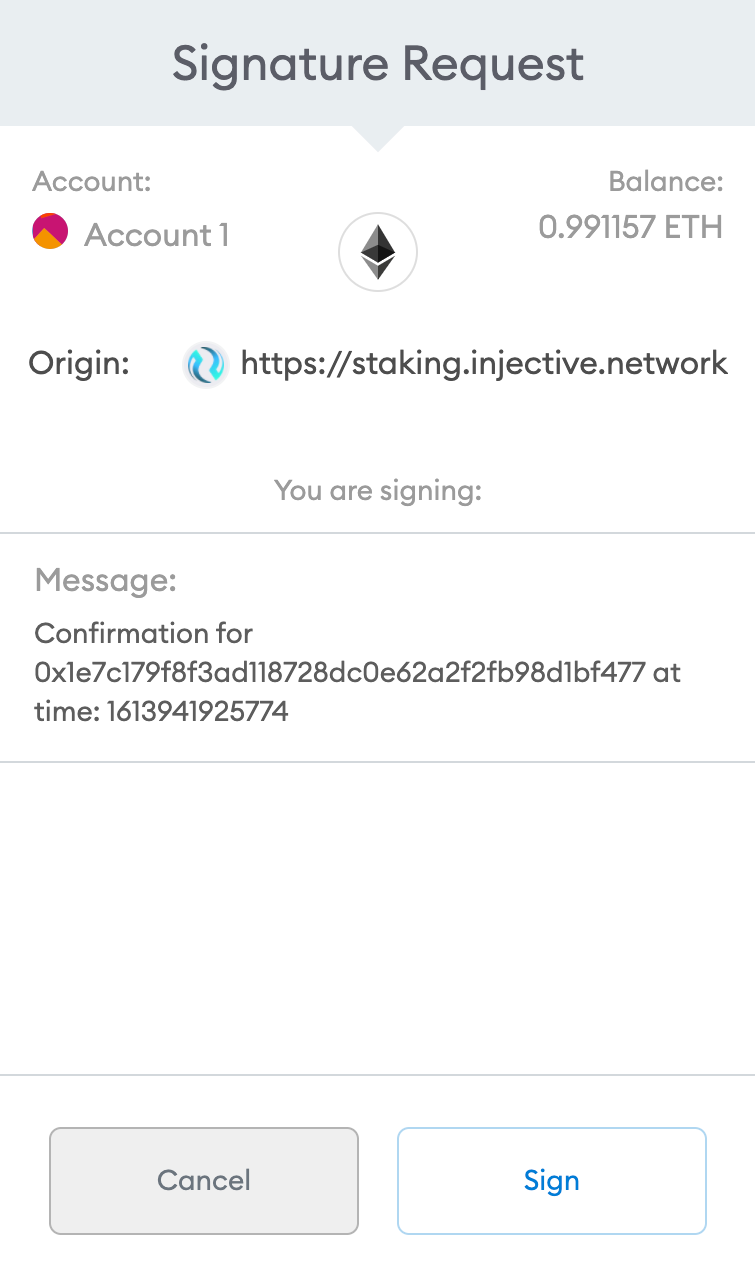

Click on the Metamask option and complete the signature request by clicking Sign. This will allow you to access the Staking Dashboard, where you will be able to view the Insurance Funds and start staking.

Note: You can also use Ledger to connect to the staking dashboard.

2. Transfer ERC-20 USDT Tokens from Kovan to Injective Chain

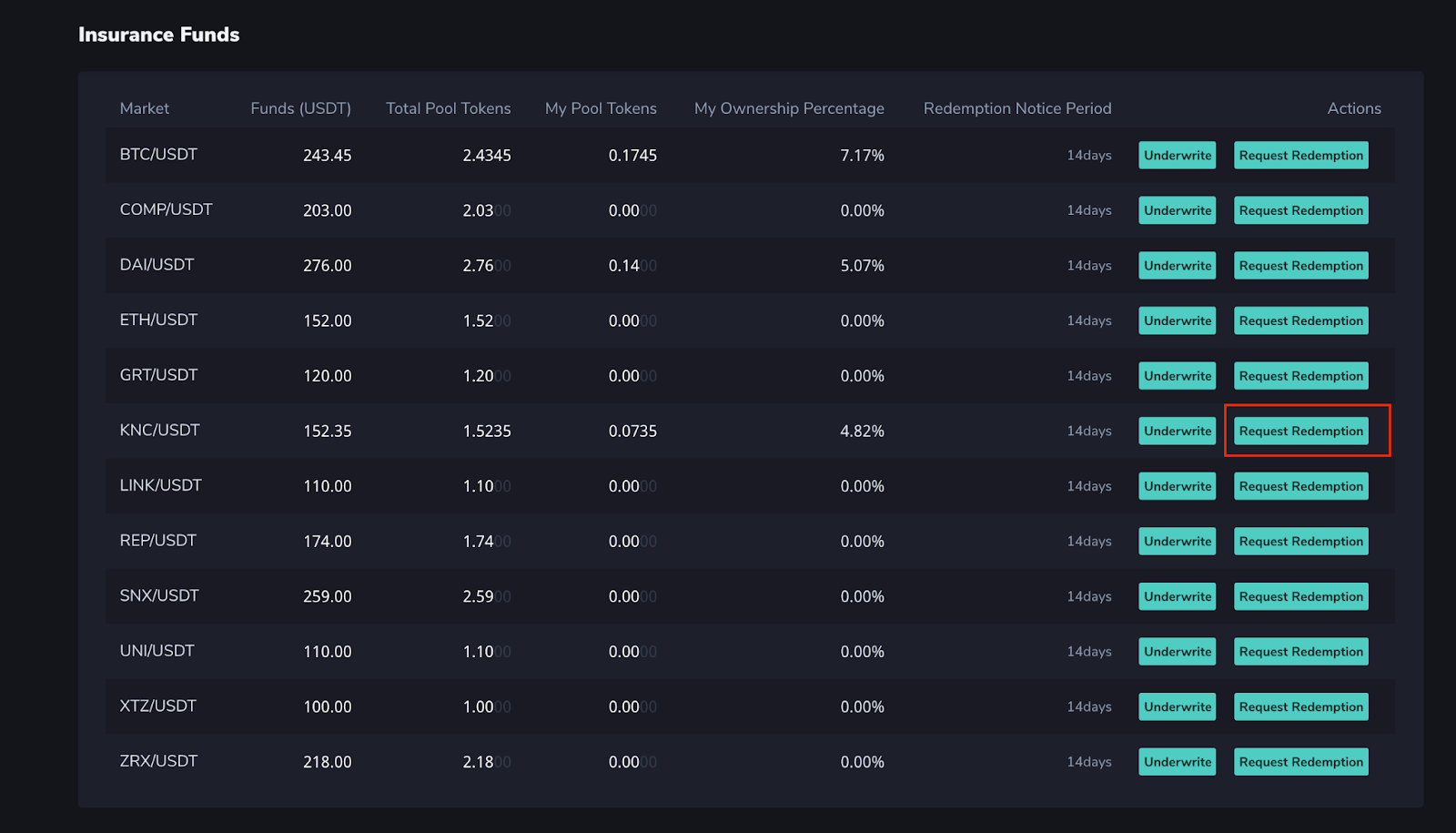

Insurance Fund staking allows users to underwrite their tokens to an insurance fund, which on Injective Protocol corresponds to one derivative market. When a user underwrites insurance for a derivative market, he stakes the collateral currency for that market and in turn receives insurance pool tokens specific to that market.

These pool tokens represent pro-rata (proportional) ownership of the insurance fund. Thus, as an insurance fund grows from liquidation proceeds, the insurance fund stakers gain profit from the increase in value of their stake in the insurance fund.

The first step to underwriting your assets on the Equinox Staking is to transfer your tokens to the Injective Chain. As we have done this before when delegating to a validator, the process is fairly similar.

First, navigate to the Insurance Fund page in our Staking Dashboard.

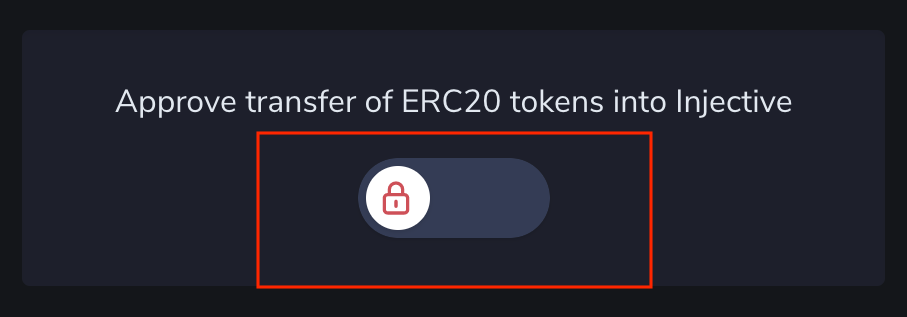

Click the unlock button on the Stake page to approve the transfer of your tokens by our Peggy contract.

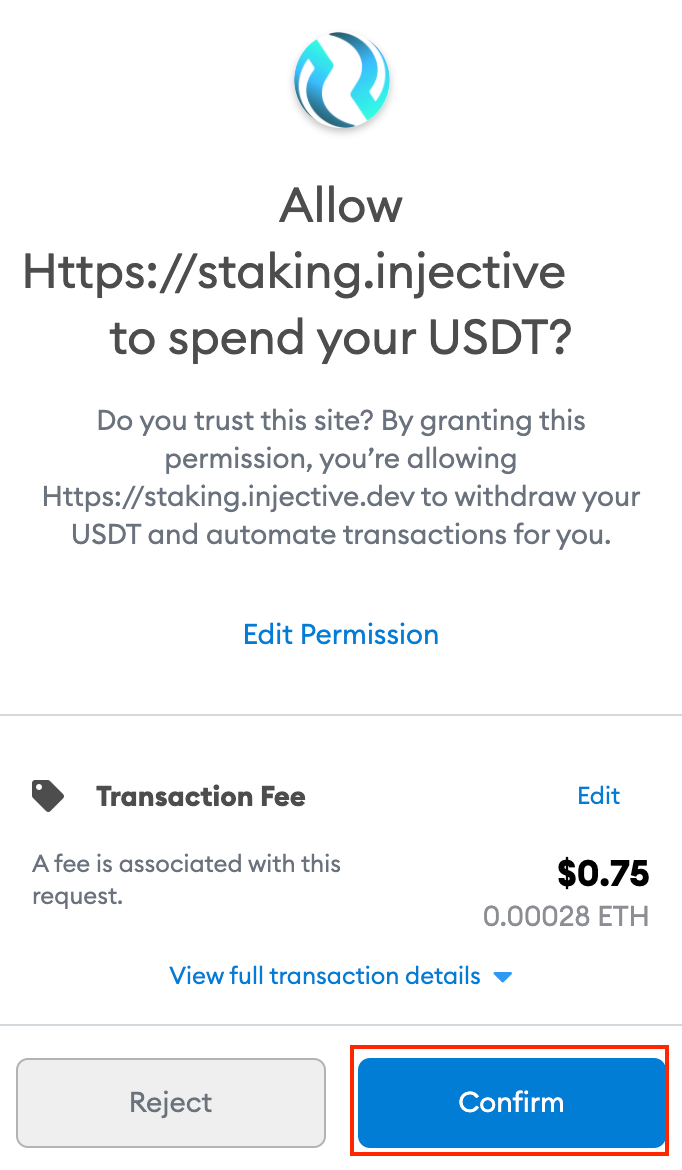

Metamask will open asking you to approve the transaction. Click Confirm.

Note: Depending on how much gas you submitted with the transaction, your transaction may either be processed quickly or take several minutes. If you run into an issue with the approval process taking very long, you may want to try refreshing the page or consider speeding up the transaction by paying more gas.

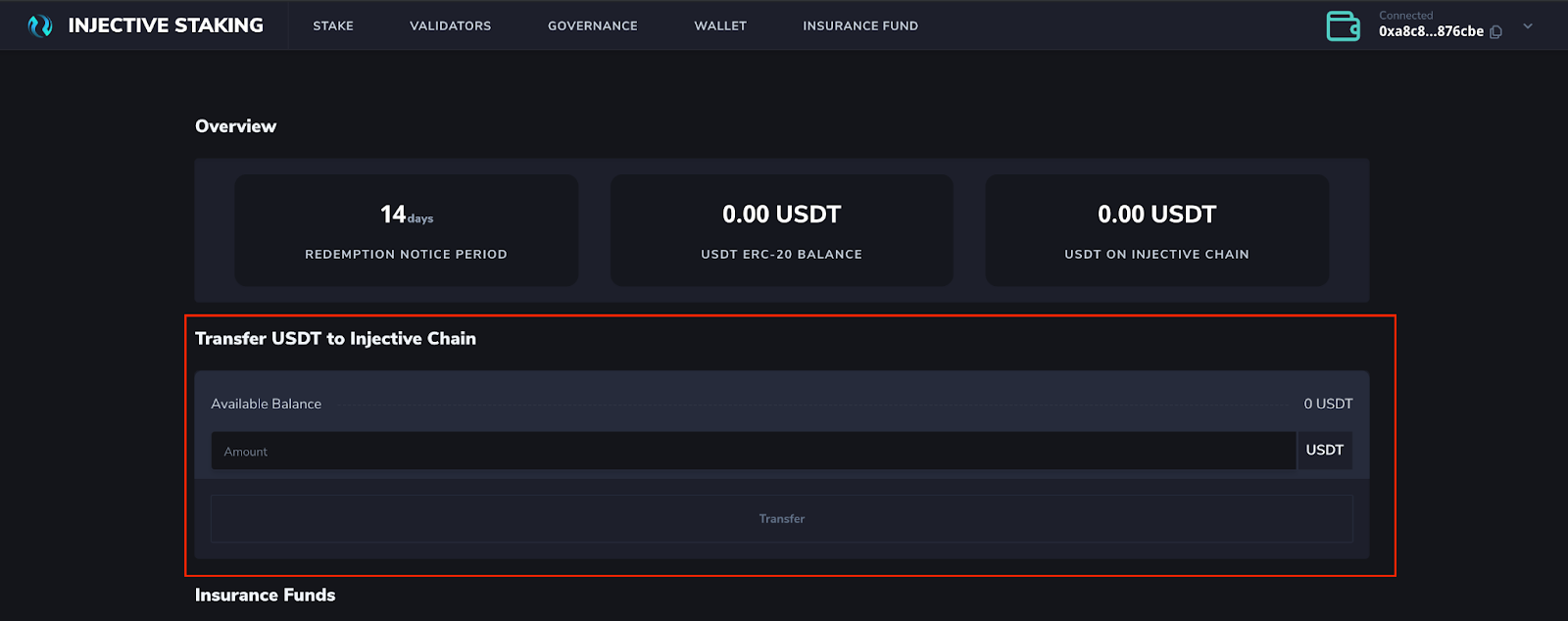

Once the transaction is completed on Kovan, the Insurance Fund page will display a form where you can enter the amount of your ERC20 USDT tokens you would like to transfer to the Injective Chain.

As we can notice, we have 0 USDT in our Kovan Wallet, so the next step would be to mint some free USDT on the Kovan Network.

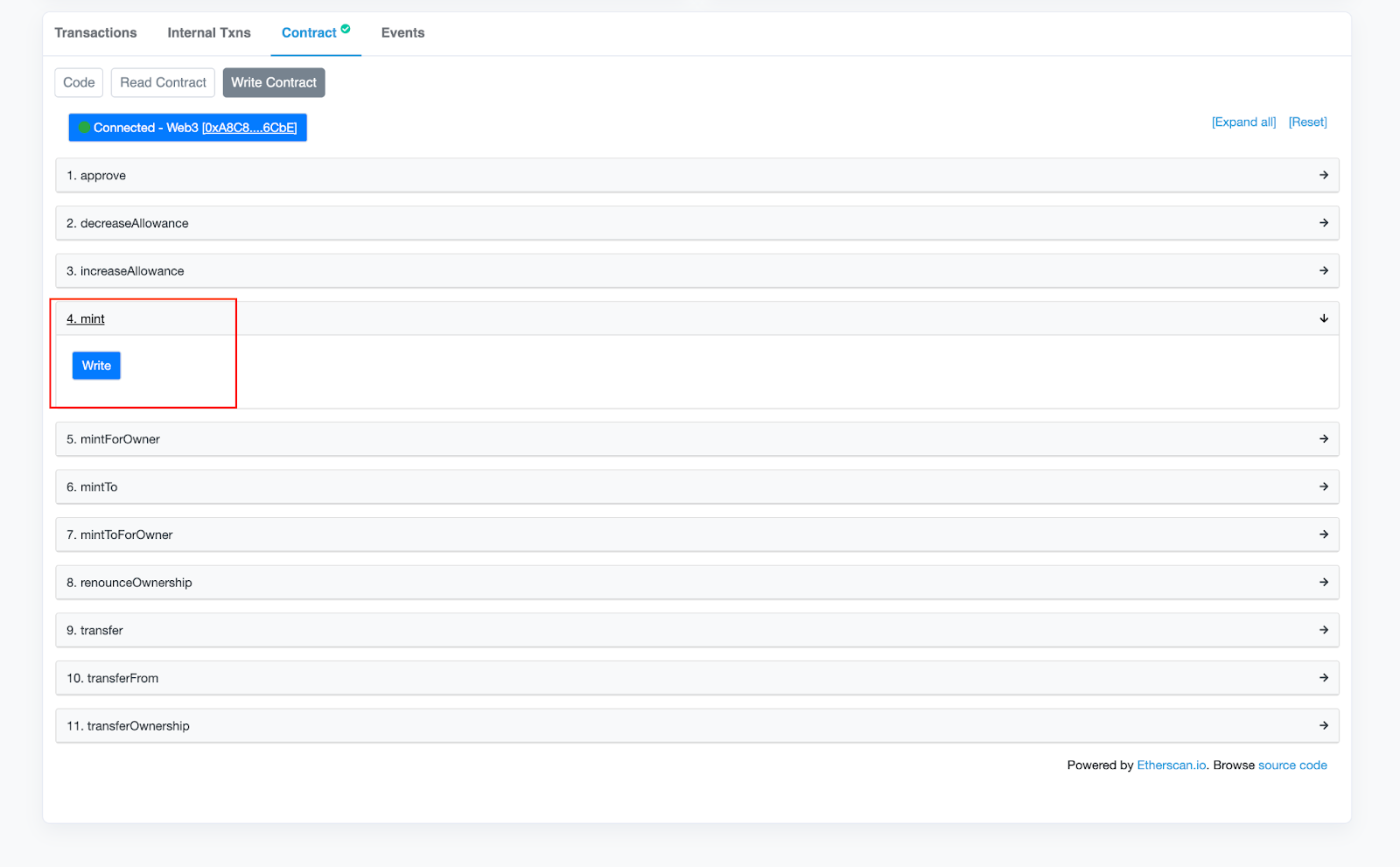

First, head to the USDT Contract Address on Etherscan and click on the Contract tab. Next, click on the “Write Contract” tab and connect Etherscan to your Metamask.

Finally, select the “mint” function, and click on the write button. A popup will appear in your Metamask. Confirm the transaction and you have successfully minted 100 Kovan USDT to your address.

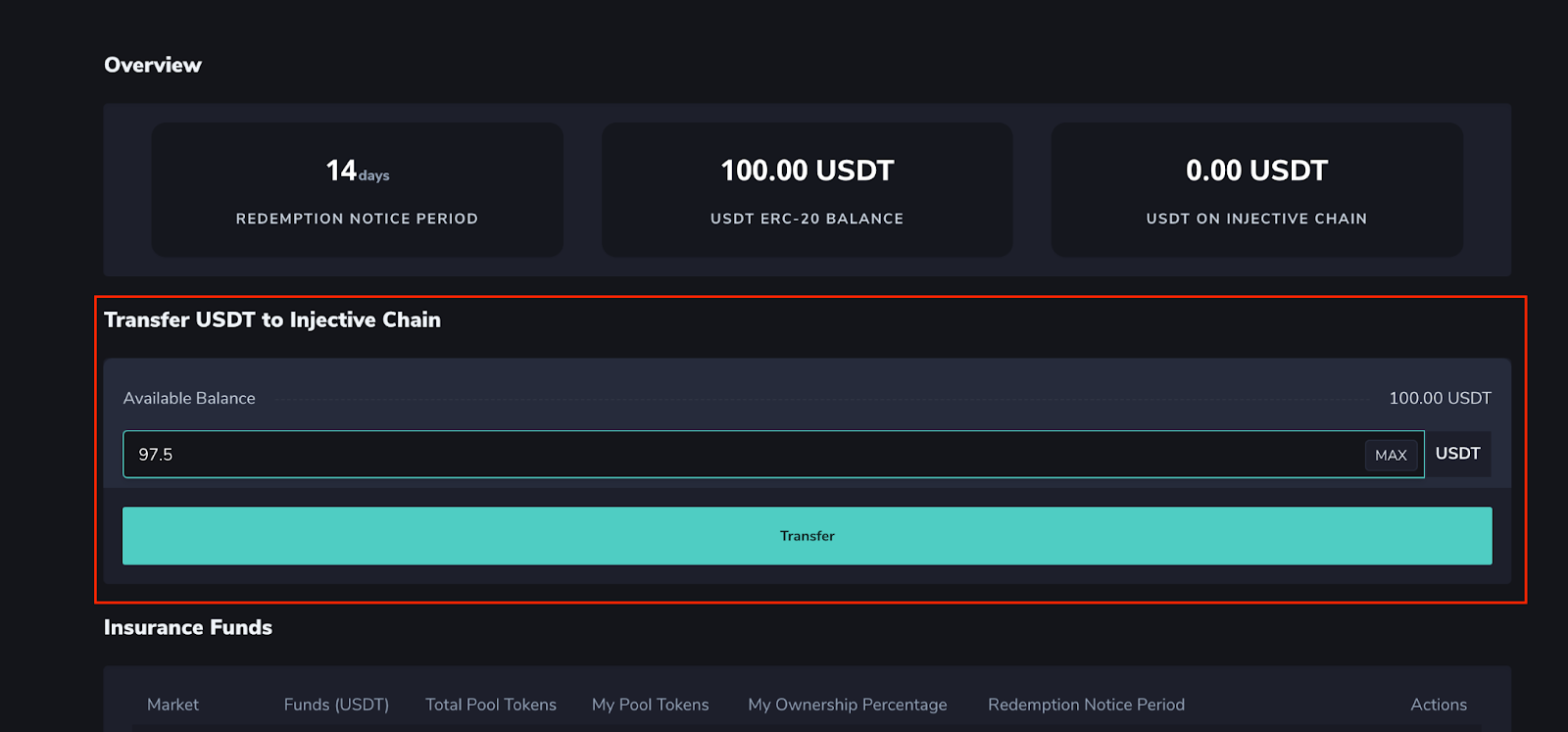

Now, go back to the Staking Dashboard and refresh the Insurance Fund page. Enter the desired amount of USDT you want to transfer to the Injective Chain in the form field, click on Transfer and sign the transaction.

Once your transaction is confirmed on Kovan, you should see a Successfully Transferred notification appear in the bottom right of your screen. Your Injective Chain USDT balance should update to reflect your transfer between networks.

Note: Refresh the page if your Injective Chain USDT balance is not updated within a few minutes.

2. Underwrite an Insurance Fund

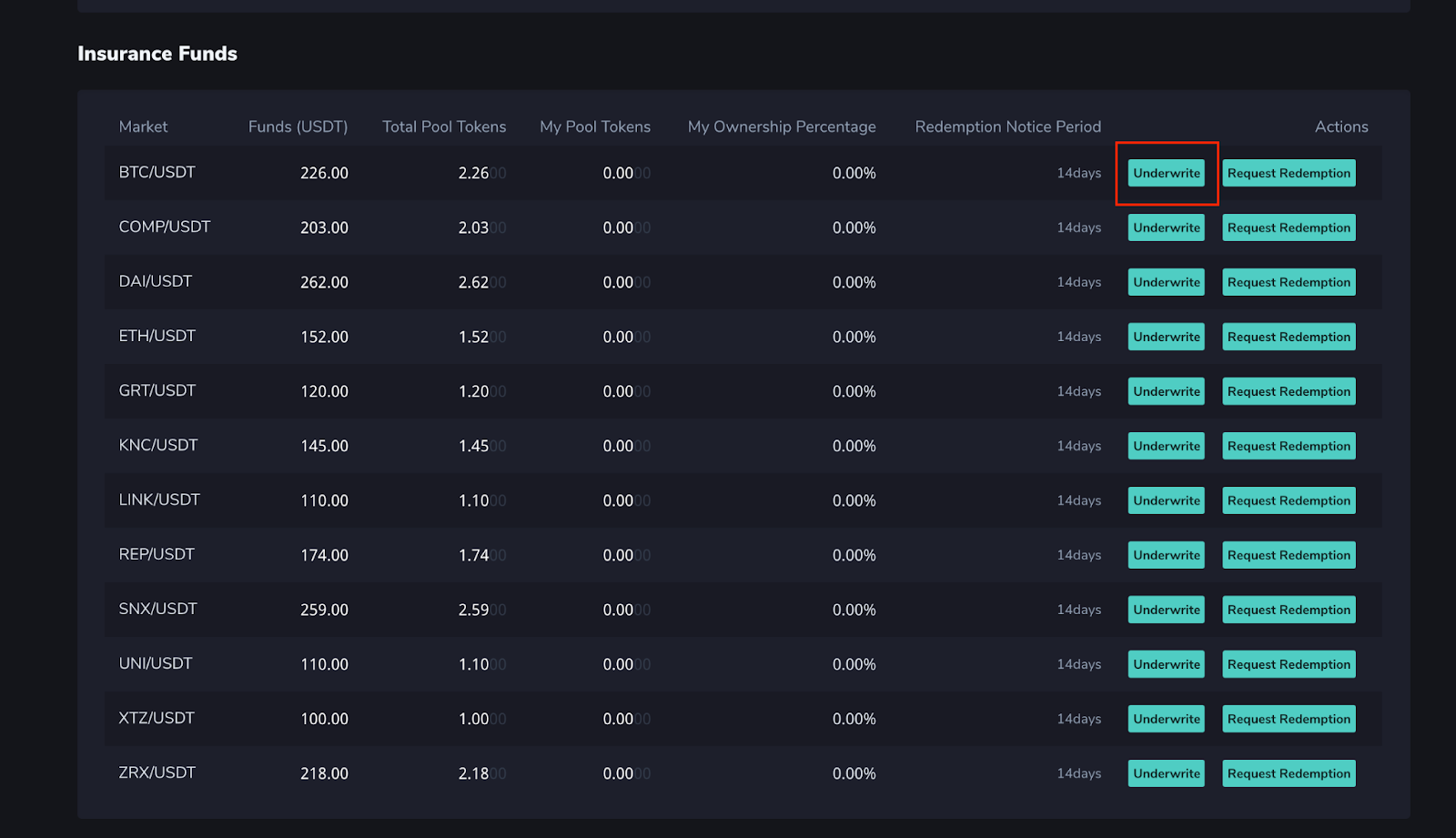

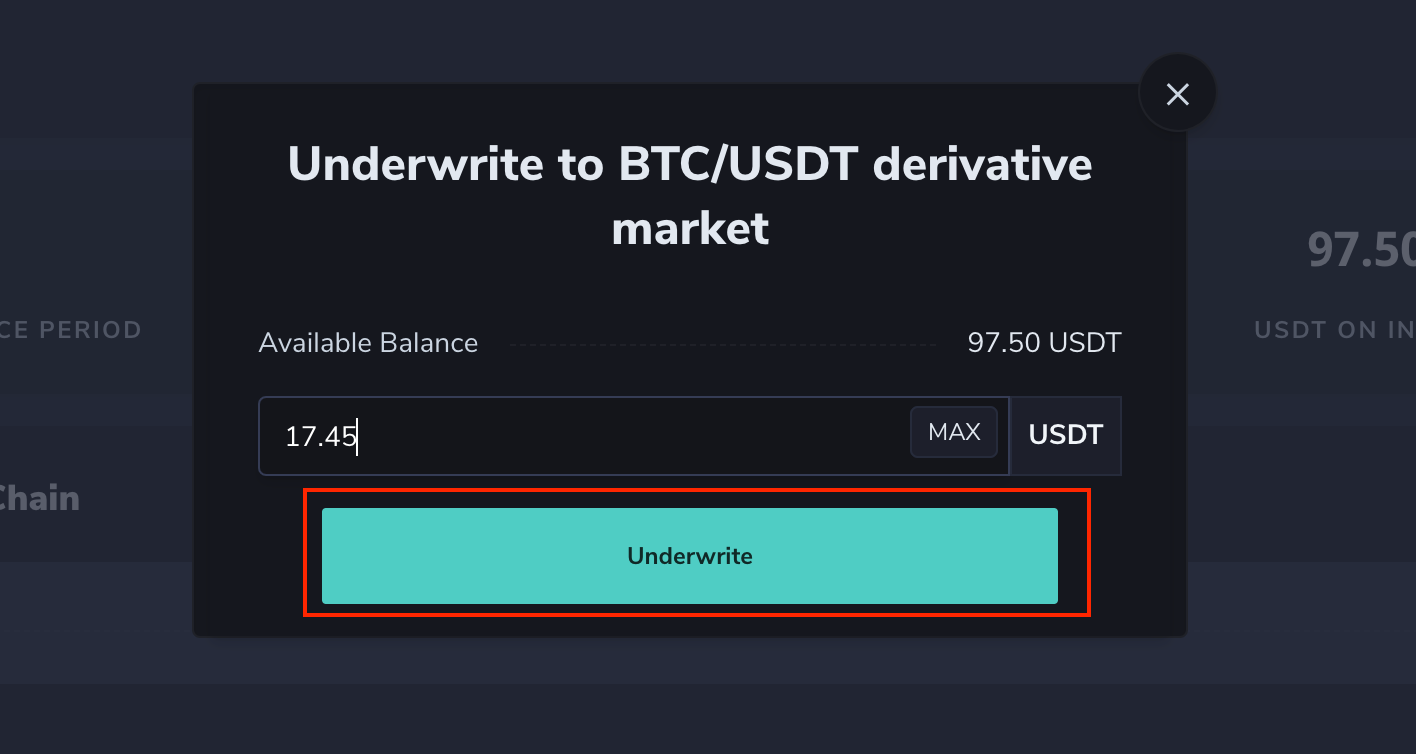

First, select the Insurance pool that you want to underwrite and click on the Underwrite button.

Next, on the modal, enter the desired amount you want to underwrite to the insurance fund, click on the Underwrite button, and sign the transaction.

After you get a confirmation that you have successfully underwritten to the insurance pool, the UI will be updated to reflect your token pool and the percentage of the tokens you own in the insurance pool you have just underwritten.

3. Request redemption from an Insurance Fund

You can request redemption to sell part (or all) of your tokens in an insurance fund that you are actively underwriting.

First, click on the Request Redemption button to begin the withdrawal process for a specific insurance fund.

Next, on the modal, enter the desired token pool shares you want to request redemption for, click on the Request Redemption button, and sign the transaction.

In the pending redemption table, you can now see your request for redemption and its completion time.

4. Closing Remarks

That is all! You are now equipped with the information needed to stake on Insurance Funds on Injective.

If you have any further questions please read the FAQs in the Insurance Fund page on the Staking Dashboard or join our Discord channel, where you will be able to speak directly with our team members.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter