As March marches on, Injective further cements its position at the forefront of the decentralized finance industry, embodying continuous progress and groundbreaking innovation. This month has been filled with significant developments and updates, including the launch of inEVM on Injective’s mainnet and pivotal upgrades like the enhancement of the Injective Bridge, each marking yet another milestone in the ongoing saga of extraordinary accomplishments within the Injective ecosystem.

A pivotal moment in March was the launch of Injective's inEVM on mainnet, a groundbreaking milestone in virtual machine development with the first rollup to hyperscale concurrent VM innovation. This transformative update redefines the dApp development and execution landscape, offering unmatched scalability, speed, and efficiency. By enabling the simultaneous processing of transactions, inEVM not only significantly boosts the Injective ecosystem's performance but also further unites Injective and Ethereum. This enhancement expands Injective's technological horizons and enriches user experience, providing a more dynamic, responsive, and integrated environment for both developers and users.

Another highlight during the month of March was the unveiling of the Ionic Upgrade to the Injective Bridge, marking a significant leap in blockchain interoperability and efficiency. This next-generation update revolutionizes the way assets are transferred across different ecosystems, streamlining the process with enhanced security and speed. This advancement not only broadens the scope of Injective's capabilities but also significantly improves the user experience, making cross-chain transactions more seamless and reliable than ever before.

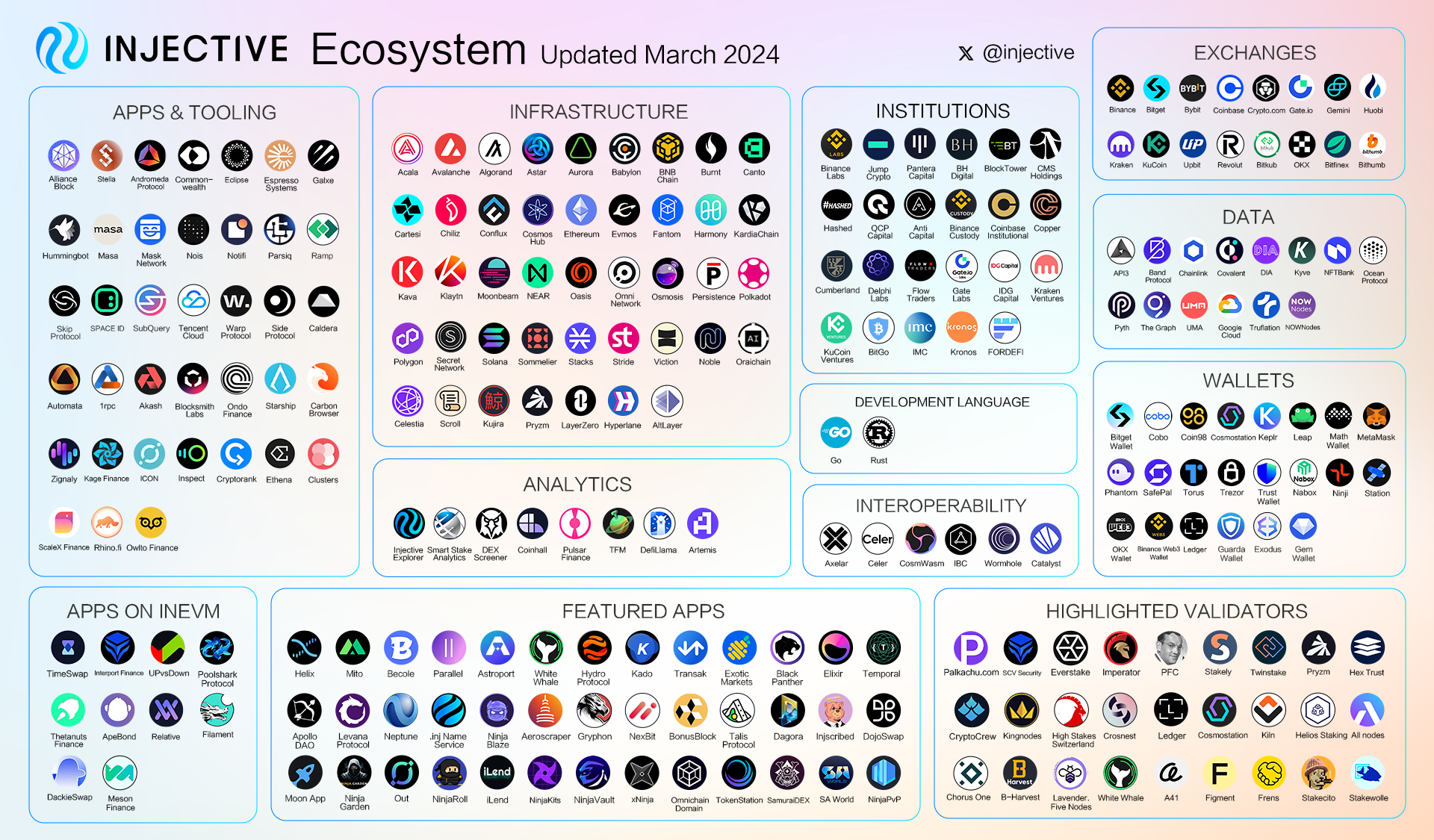

The Injective ecosystem also expanded during this month with a number of dApps launching on mainnet and a recorded number of over 540 million on-chain transactions, showcasing Injective’s scalability and growing presence in the Web3 scene.

Highlighted Ecosystem News

inEVM Mainnet Launch

1/ Injective #inEVM is live on mainnet, the first ever rollup designed to supercharge concurrent VM development.

— Injective 🥷 (@injective) March 7, 2024

inEVM enables Ethereum developers to build dApps that leverage blazing fast speeds & near zero fees while achieving composability across WASM and EVM

Read on 👇 pic.twitter.com/OXtPQTVnvx

The inEVM's mainnet launch on Injective is a groundbreaking event in DeFi, introducing the first rollup to hyperscale concurrent virtual machine (VM) development. This leap forward propels decentralized computing into a new era, significantly enhancing the efficiency, scalability, and interoperability of dApp development and deployment.

This deployment is particularly revolutionary for its ability to bridge the functionalities of Injective and Ethereum, creating a unified platform where developers can leverage the best of both ecosystems. The introduction of inEVM on the mainnet is notable for its sophisticated architecture, which promises to refine development processes, offer a wide array of application possibilities, and simplify interactions with blockchain technologies. These advancements aim to make the decentralized web more accessible and versatile, catering to a broad spectrum of user needs and preferences.

With the rollout of inEVM, Injective is not just enhancing its own ecosystem but also contributing to a more cohesive and efficient blockchain infrastructure. This development marks a significant stride towards realizing a fully interoperable and high-performing decentralized finance landscape, underlying Injective's commitment to innovation and its pivotal role in the evolution of blockchain technology.

Injective Bridge Ionic Upgrade

1/ Today, Injective is unveiling the Ionic upgrade to the Injective Bridge 🌁

— Injective 🥷 (@injective) March 26, 2024

Advanced interoperability meets superior UX with near 0 fees.

Now users can take advantage of a one click bridging experience across chains like Solana, Cosmos and Ethereum.

Keep reading 🧵

The launch of the Ionic upgrade to the Injective Bridge marks a transformative moment in interoperability and functionality. This next-generation enhancement elevates the Injective ecosystem, setting a new standard for asset transfers between diverse blockchain networks. By optimizing the bridge's architecture for greater efficiency, security, and speed, the Ionic upgrade facilitates a smoother, more reliable cross-chain interaction, significantly improving the user experience for both seasoned blockchain enthusiasts and newcomers alike.

With the Ionic upgrade, the Injective Bridge is poised to become a cornerstone of cross-chain transactions, underpinning a more connected and seamless blockchain environment. This milestone reflects Injective's ongoing dedication to innovation and its pivotal role in shaping the future of decentralized finance, further solidifying its position as a leader in the blockchain space.

Ethena Shards Expands Beyond Ethereum and Launches Exclusively on Injective

1/ @ethena_labs is integrating with Injective today, marking its first expansion outside of the Ethereum ecosystem.

— Injective 🥷 (@injective) March 6, 2024

Both the Injective and the broader IBC community now have access to USDe, enabling users to earn Ethena Shards beginning on March 11th.

Details below 👇

The launch of Ethena Shards outside of Ethereum, exclusively on Injective, marks a significant expansion in the scope of cross-chain assets, fostering a more inclusive and diverse blockchain ecosystem. This strategic move introduces a novel asset class to the Injective platform, and sets a new precedent for asset interoperability and innovation within the DeFi space.

This collaboration paves the way for Injective and the wider IBC community to access USDe and participate in Ethena’s widely popular Shard Campaign.

Users can earn 15x shards by joining the USDe/USDT vault on Mito, while also enjoying a 28.91% APY yield* as a vault LP holder.

*At the time of publishing.

SA World Launches on Injective

1/ This past week, one of the largest gaming infrastructure platforms, @SAWorld_io, announced a major move to release on Injective. What is SA World, and what does this mean for Injective?

— Injective 🥷 (@injective) March 30, 2024

SA World announced a strategic migration from Polygon and BNB Chain to launch exclusive on Injective, signifying a pivotal shift towards supercharging the GameFi sector on Injective. By choosing Injective as its new home, SA World aims to leverage the platform's superior speed, efficiency, and interoperability features, promising a seamless and enriched gaming experience for its users.

This migration is indicative of the growing trend of gaming platforms recognizing the value of robust blockchain networks like Injective to unlock new possibilities in gameplay, economics, and community engagement. It underlines Injective's growing influence and capability in supporting high-demand sectors like GameFi, setting new standards for what is achievable in terms of game development and player interaction in a decentralized setting. Moreover, SA World's move to Injective is expected to pave the way for further innovations and collaborations in the GameFi space, contributing to the evolution of gaming on the blockchain and reinforcing Injective's position at the forefront of this exciting intersection between gaming and DeFi.

Full List of Injective Updates

Ecosystem Updates

- Wormhole is airdropping Injective users that used Wormhole to bridge into Injective.

- LayerZero launched on inEVM.

- ApeBond, a project building a sustainable DeFi future launched on inEVM.

- Thetanuts Finance is the first options protocol to deploy on inEVM .

- Gryphon, the decentralized liquid staking protocol on Injective, announced that nUSD is coming soon.

- Mito, an automated trading vault and launchpad launched a USDe vault.

- DeFi Llama now tracks Injective’s inEVM.

- MathWallet is supporting inEVM.

- Injective collaborates with AltLayer to create the first ever restaked security framework for on-chain inEVM applications.

- Relative Finance launched its peer-to-peer relative value wagers on inEVM.

- TokenStation, a native Injective token launcher, is live.

- Helix, a decentralized exchange on Injective announced a $PYTH genesis airdrop for the most dedicated community members.

Chain Updates:

- Injective launched inEVM on mainnet.

- OKX Web3 Wallet integrated Injective.

- Ethena Labs integrated Injective marking its first expansion outside of the Ethereum ecosystem.

- Galxe integrated Injective to push community engagement and growth across their platform.

- Bonfida now allows users to use their .sol domain on Injective to send and receive funds with Leap wallet app and extension.

- Partnership with Noble to bring native USDC to Injective.

- Artemis integrated Injective to provide institutional-grade analytics for ecosystem users and dApps.

- Clusters, the fastest growing cross-chain name service integrated Injective.

Injective Stats:

- Injective surpassed over 500M on-chain transactions.

- Injective produced over 65 million blocks on mainnet.

- Injective reached 450,000 active wallets.

- Injective reached over 210,000 unique delegates.

- Injective has over 50,600,000 $INJ staked.

- A total of 25,458 INJ was burned through weekly burn auctions in March, and a total of 5.88 million INJ has been burned to date with over 142 burns.

- The total gas fees paid by users on Injective to date is zero.

- Injective hit over 522 followers on Twitter and 532 members on Discord.

- The INJ staking APR on Injective is 15.57% with over 50.6 million INJ staked.

- The total trading volume on exchange dApps on Injective reached $2.9B in March, with its peak daily volume on March 5th reaching $188.9M volume. The most liquid markets are BTC and ETH perpetuals.

- The markets on Injective exchange dApps performed well this month, with Bitcoin (BTC) increasing from 62,100 to 70,472, marking a 13.5% surge. Dogwifhat (WIF) showed significant growth, rising from 1.19 to 4.49, indicating a substantial 277.3% increase.

Community Updates:

- Injective sponsored ETH Denver and had a claw machine at the booth.

- Injective hosted a side event with Copper in London during DAS.

- Eric Chen, CEO of Injective Labs will present during Solana Crossroads.

- Injective hosted Ethena for a Twitter Space discussion.

- inEVM AMA with Hyperlane and Caldera.

- Injective hosted a side event during Korea’s BUIDL week.

- Injective launched ambassador badges on Galxe.

- Eric Chen spoke to Forbes about the groundbreaking infrastructure enabling a new era of RWA tokenization.

- Injective hosted Noble for a Twitter Space conversation on native USDC on Injective.

- The first Injective quadratic funding round went live on DoraHacks with a total matching pool of 1,500 INJ.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Learn | Youtube | Facebook|LinkedIn | Reddit | Instagram | Orbit Newsletter