Injective is excited to announce the launch of AINJ, the Injective Staking Exchange-Traded Product (ETP) by 21Shares. AINJ is a groundbreaking new product that allows users to gain exposure to INJ via major traditional finance exchange venues and brokerages while also capturing staking rewards. This product represents a pivotal step forward in Injective’s commitment to integrating with traditional markets and institutions.

AINJ is provided by 21Shares, a primary issuer of crypto ETPs. 21Shares has a strong track record of working with the largest crypto projects in the space, bringing innovative financial products to market and facilitating greater institutional involvement in the digital asset space. 21Shares has recently been one of the main institutions to spearhead efforts for the Bitcoin ETF alongside Cathie Wood’s Ark Invest with over $3 Billion of assets under management for this product offering alone. Their experience and reputation ensure that AINJ is backed by a reliable and established partner.

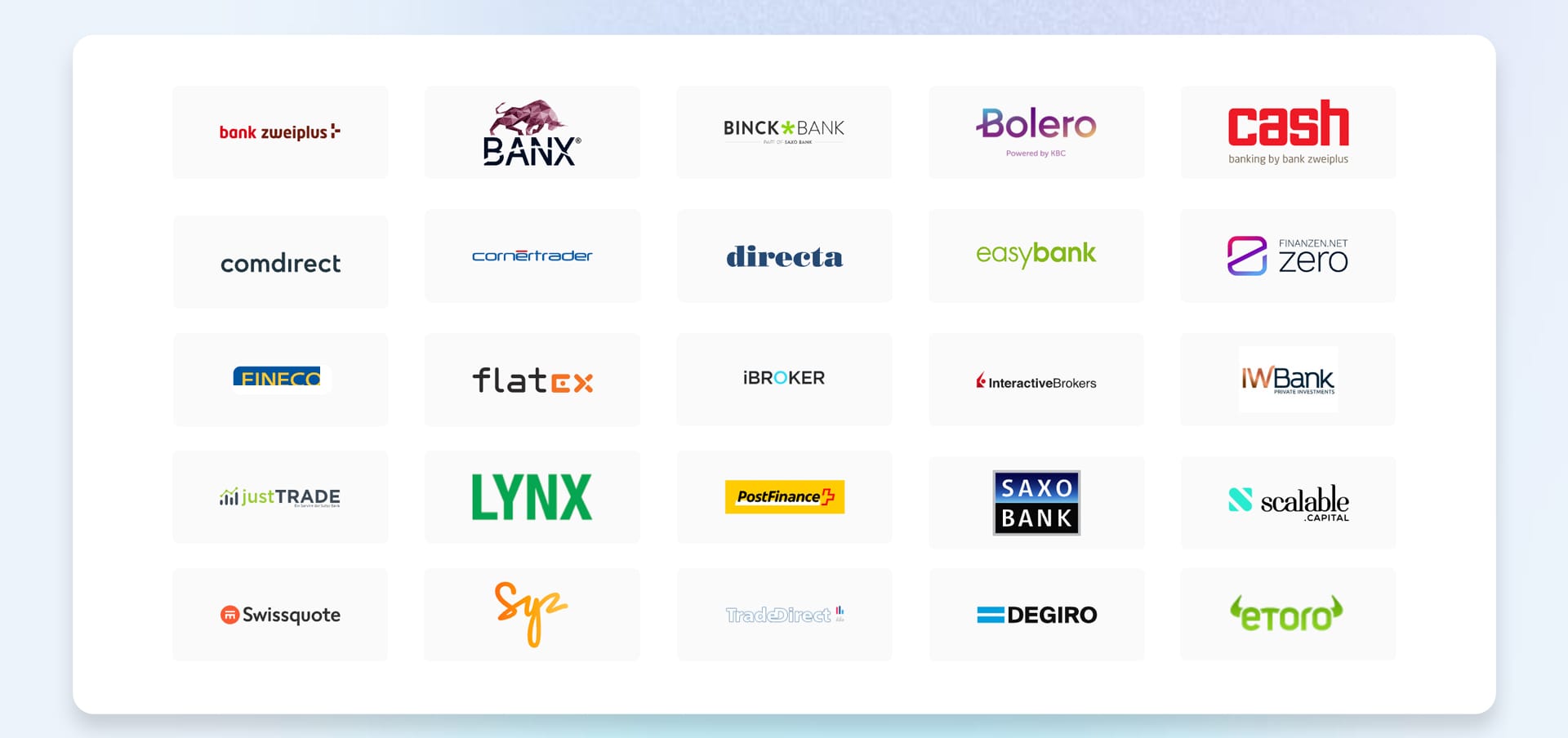

The introduction of AINJ is a significant milestone for institutional adoption, opening new gateways for large-scale entities to engage with Injective. This regulated, transparent product simplifies institutional participation and is already supported by some of the world’s leading traditional finance exchanges and brokerages such as Interactive Brokers, Saxo Bank, Swissquote, and eToro, among others.

Currently, there are only a handful of select crypto assets with one or more associated ETPs globally. This highly selective pool of assets underscores the importance and innovation behind AINJ, as it joins an exclusive list of offerings that provide institutional and everyday participants with access to the burgeoning digital asset landscape.

What is an ETP?

Exchange Traded Products (ETPs) are a class of financial instruments traded on stock exchanges that provide exposure to various underlying assets without the need to own them directly. These assets can range from stocks and bonds to commodities and crypto assets. ETPs offer a straightforward way to participate in a diversified portfolio, combining the ease of stock trading with the benefits of mutual funds.

Types of ETPs

- ETFs (Exchange Traded Funds): Track the performance of a specific index, sector, or commodity. They are designed to mimic the returns of the underlying assets they represent.

- ETCs (Exchange Traded Commodities): Provide direct exposure to commodity prices. They can track single commodities like gold or a basket of commodities.

Benefits of ETPs

- Diversification: ETPs allow for exposure to a broad range of assets, spreading risk across various sectors and asset classes.

- Liquidity: ETPs are traded on stock exchanges and can be bought and sold throughout the trading day at market prices, providing higher liquidity.

- Transparency: ETPs typically disclose their holdings daily, providing clear insights into the underlying assets and ensuring transparency.

- Cost-Effectiveness: ETPs generally have lower expense ratios compared to mutual funds. This cost efficiency stems from their passive management structure.

Structures of ETPs

- Physical ETPs: Hold the actual underlying assets they track, ensuring a direct correlation with the asset and reducing counterparty risk. However, this structure may incur higher operational expenses due to the costs of physical storage and potentially face liquidity challenges. In the context of blockchain, these disadvantages are less prevalent due to the nature of digital assets. AINJ is a physically backed ETP for example.

- Synthetic ETPs: Use financial derivatives (e.g., swaps, futures) to replicate the performance of underlying assets. This approach is traditionally more cost-efficient and provides access to otherwise hard-to-trade assets. The trade-off includes increased counterparty default risk and added complexity due to the use of derivatives, which can reduce transparency.

How AINJ Works

Provided by 21Shares, AINJ offers a unique way to gain exposure to INJ in a regulated environment. By combining the benefits of staking with the convenience and efficiency of an ETP, AINJ is a comprehensive and dynamic instrument for benchmarking INJ.

- Staking Yields: AINJ captures the staking yields generated by staking INJ to secure the Injective network. These staking rewards are then reinvested into the ETP.

- 100% Physically-Backed: AINJ is structured as a Physical ETP, backed 100% by the underlying INJ and kept in cold storage by an institutional-grade custodian. Digital assets have low storage costs, allowing AINJ to offer the most direct correlation to its underlying asset without increased operational expenditures.

- Regulated and Transparent: AINJ operates within a regulated framework, ensuring all transactions and holdings are clear and accessible.

- Convenience and Efficiency: By trading AINJ on stock exchanges, buying and selling the ETP is easily conducted throughout the trading day. This flexibility provides a convenient and efficient way to gain exposure to INJ and the associated staking rewards without the complexities of directly managing staking processes.

- Accessibility: AINJ is supported by 25 different banks and brokerages, trading on both the Euronext Amsterdam (AINJ NA) and Euronext Paris (AINJ FP).

Notable Banks and Brokerages Supporting AINJ

- Interactive Brokers (IBKR): With approximately 2.5 million clients across 200 countries and territories, IBKR manages over $370 billion in assets and supports 150 exchanges.

- Saxo Bank: Serving over 1 million retail and institutional clients, Saxo Bank operates in numerous countries, supporting trading in over 40,000 financial instruments across multiple asset classes, and powers over 200 banks and over 400 financial intermediaries.

- Swissquote: A leading Swiss online bank, Swissquote manages assets worth over CHF 50 billion (~$55 billion), serves over 570,000 clients, and offers over 3 million different products.

- eToro: With a user base exceeding 30 million across more than 100 countries, eToro manages billions in assets and is known for its social trading features.

These institutions offer robust infrastructure for the Injective Staking ETP, exemplified by their substantial AUM, extensive client bases, and wide geographical reach. With an established presence in the financial industry, their participation underscores Injective’s commitment and progress in integrating with traditional markets and institutions.

Conclusion

AINJ represents a significant advancement in providing broader and more efficient access to the performance and staking rewards of INJ, the native asset of the Injective ecosystem. By leveraging the benefits of both physical backing and staking yields, AINJ offers a unique opportunity within a regulated and transparent framework. Supported by some of the largest banks and brokerages, AINJ exemplifies Injective’s commitment to integrating with traditional financial markets while advancing the possibilities within decentralized finance.

Explore AINJ today to experience the innovative benefits of the Injective Staking ETP.

Legal Disclaimer

This article is intended for informational purposes only and is not: financial or investment advice; an offer to buy or sell any product; or an endorsement of any product.

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native asset that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter